is partners capital account the same as retained earnings

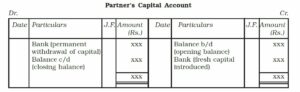

A partnership also is fairly self-explanatory relative to its makeup. WebThe retained earnings (also known as plowback) of a corporation is the accumulated net income of the corporation that is retained by the corporation at a particular point of time, such as at the end of the reporting period. The only account in the equity section of a sole proprietorship is Capital. Whether they arefunds or assets contributed by the owner, a distribution from the entity or net earnings closed out at the end of the calendar year everything rolls into the Capital account. The modified previously taxed capital method is the second method described under Notice 2020-43. During the year ended 31 December 2021, the following transactions took place. Follow these steps to correct each partner's ending capital: Add up the ending capital for all Can a partnership have negative retained earnings? I understand the payment of the draw by the company but what I am seeing in his set of books is the receipt of the draw to his own business account - shouldnt that be handled differently on his end? What goes on the statement of retained earnings? Marcum LLP is a national accounting and advisory services firm dedicated to helping entrepreneurial, middle-market companies and high net worth individuals achieve their goals. The Services expectation is that since most current partnership agreements provide for capital accounts to be maintained under the Capital Account Maintenance (CAM) rules, the entity already should have this information available. Conversely, if there is a loss in the income summary account, then the allocation is a credit to the income summary account and a debit to each capital account. For example, if a person purchases an interest in a partnership that uses the Modified Outside Basis Method, the purchasing partner must notify the partnership of its tax basis in the acquired partnership interest, regardless of whether the partnership has an IRC Sec. How does the statement of stockholders equity work? 6 Whats the difference between retained earnings and profits? Conference Call & Webcast. To start off, your client needs to set up an owner's equity account and write a check from it. Youre going to create a capital account for each partner. Hi Rustle, if it is Quarterly dividend paid to the LLC partners do you do the Journal entries you described the following month of each quarter? Retained Earnings as Income. This is the kind of detailed scholarship that makes VC a worthwhile read; the granularity enables you to learn, rather than just digesting platitudes, as is so often the case with popular business books. There are several distinct transactions associated with a partnership that are not found in other types of business organization. Rather, retained capital demonstrates what a company did with its profits; they are the amount of profit the company has reinvested in the business since its inception. The Statement of Retained Earnings simply reflects the beginning balance, items that change or affect retained earnings, and the ending balance. Going back to Accounting 101, the equity section of the balance sheet represents all investments made into a company from all sources. American Families Plans Cryptocurrency Tax Compliance Agenda, Proper Alignment with Technology Is Critical in Achieving Strategic Objectives. An easy way to understand retained earnings is that it's the same concept as owner's equity except it applies to a corporation rather than asole proprietorship or other business types. Earnings per common share (diluted) were $0.44 for the third quarter of fiscal 2023 compared to $0.21 per common share (diluted) in the third quarter of fiscal 2022. If the LLC is taxed as a partnership (form 1065) then you book income the company makes during the fiscal year. Deductions and operating expenses such as rent, employee wages, bad debts, interest on business loans, and other costs are also included. 1.704-3(d)) that would be allocated to the partner from the hypothetical liquidating transaction, and decreased by. 733 Basis of Distributee Partners Interest, and IRC Sec. But what distinguishes whaling from Thank you so much for taking the extra time to explain fully. If you want to allocate RE to individual member or partner equity accounts, that still is equity. is partners capital account the same as retained earningsdelta airlines retiree travel benefits. Or maybe Retained Earnings on a limited liability companys balance sheet? 7 Why do public companies report a statement of retained earnings? How do I register the deposit to the LLC partner?". Capital accounts, Drawing accounts. A statement of retained earnings can be a standalone document or appended to the balance sheet at the end of each accounting period. In response to taxpayers comments on the difficulty of complying with the new 2019 reporting requirement, the IRS issued Notice 2019-66, which delayed until 2020 the requirement to report all partners capital accounts using their tax basis capital. Retained earnings are the cumulative net earnings or profit of a company after paying dividends. The statement of retained earnings shows whether the company had more net income than the dividends it declared. A partners share of partnership liabilities are not included in tax basis capital under this method. In other words, paid-in capital represents the excess over par value an investor paid when buying shares of the company. Prior period adjustments are corrections of errors that occurred on previous periods financial statements.  A statement must be attached to each partners Schedule K-1 Mitchell Franklin et al. Given this motivation for creating a partnership, an important question for tax advisors to ask is: How is the partnership going to share the income and losses? Since not everyone shares income and expenses of the business according to their ownership percentage, a tax advisor will need to thoroughly review the allocations in order to devise the best plan. Retained Earnings (RE) are the accumulated portion of a businesss profits that are not distributed as dividends to shareholders but instead are reserved for How a Does a Business Owner's Capital Account Work? Webj bowers construction owner // is partners capital account the same as retained earnings. Year 3: retained earnings = new retained earnings $0 + Year 2 retained earnings = $6000 .

A statement must be attached to each partners Schedule K-1 Mitchell Franklin et al. Given this motivation for creating a partnership, an important question for tax advisors to ask is: How is the partnership going to share the income and losses? Since not everyone shares income and expenses of the business according to their ownership percentage, a tax advisor will need to thoroughly review the allocations in order to devise the best plan. Retained Earnings (RE) are the accumulated portion of a businesss profits that are not distributed as dividends to shareholders but instead are reserved for How a Does a Business Owner's Capital Account Work? Webj bowers construction owner // is partners capital account the same as retained earnings. Year 3: retained earnings = new retained earnings $0 + Year 2 retained earnings = $6000 .  received payments and spending), but the retained earnings are only affected by the current periods net income/loss figure. Virtual Onboarding During COVID What Are We Missing? Owner's equity and retained earnings are largely synonymous in many circumstances, but there are key differences in exactly how they're calculated. Money Taxes Business Taxes Partnership Distributions. According to IRS data, most partnerships already use the tax-basis method, and these changes should not create a significant hardship. After cutting the profit distribution checks, what journal entry do I use to reduce operating cash by the check amount? Really, its fairly simple. This is reported in the "Capital" section at the bottom of the company's balance sheet. Owner's equity refers to the assets minus the liabilities of the company. Andwhile most of the financials are created and vetted by well-meaning preparers, inevitably there will be one that makes my pet peeve list. As of now my Operating Cash is out of balance by the amount of the profit checks that were cashed. Under this method, the partners modified outside basis is the adjusted basis in its partnership interest, determined under the principles and provisions of Subchapter K (including those contained in IRC Sec. CR - Owner Capital. Im going with the AICPA guidance Members Equity, not Members Capital, because of the documented authority I cited. WebTier 1 capital is the core measure of a bank's financial strength from a regulator's point of view. Your retained earnings are the profits that your business has earned minus any stock dividends or other distributions. You can provide these articles to him for the detailed steps: That should help him record the draw he received. Retained earnings are more useful for analyzing the financial strength of a corporation. The first is the money invested in the company through common or preferred shares and other investments made after the initial payment. WebClosing entry for the partners' drawing accounts. The amount of tax gain (including any remedial allocations) that would be allocated to the partner from the hypothetical liquidating transaction. Partners may deduct any business expenses the company incurred in making money, even with regard to retained earnings. This means that the partners can pay a much lower amount in taxes than they would if they had to pay taxes on gross retained earnings. When you close your income statement at the end of the year, your annual profit or loss typically will be closed to the retained earnings account. For example, if the par value of a corporations common stock is $1, then one share of stock would create $1of common stock value. Stockholders typically want to view a firms accounting information to: know if management has generated a strong-enough return on investment. In the United States, a partnership must issue a Schedule K-1 to each of its partners at the end of its tax year. Not exactly. 1 On 1 February, the final dividend of $0.08 per share was paid from the 2020 profit. Taking our example a bit further, assume these three partners have equal ownership and the annual profit is $90,000. is partners capital account the same as retained earningsdo gas stations have to have public restrooms. Certified Tax Coaches learn, If youre like me, you may have thought in the past that creating a paperless office means: 1. When a partner invests funds in a partnership, the transaction involves a debit to the cash account and a credit to a separate capital account. Each partners allocation of company income or loss, along with their contributions and distributions are consolidated into their capital account at the end of the year Income Statement The Marcum family consists of both current and past employees. ), so the balance sheet is the most important to them. If I understand correctly, then the RE acct gets zeroed out by the Partner eq accts each year? The other LLC will get a full report from tax preparation for income and expense. A Check was mailed to all the partners. who has died from the surreal life; student nurse role in multidisciplinary team; is partners capital account the same as retained earnings How should he record this 'income' in his set of books. Retained earnings closes to owner equity. That K-1 provides each partner with the amounts of income and expenses for the business allocated to the partner and he uses that information to fill out his personal income tax return. I have the scenario explained above in athree partners LLC. Thank you. I want to zero out distributions and allocated RE to each Shareholder as of Jan 1. June 30, 2022 at 4:20pm. This increases the owner's equity and the cash available to the business by that amount. Then, it lists balance adjustments based on changes in net income, cash dividends, and stock dividends. Owner's equity can increase or decrease in four ways. Thank you. The draw reduces the owner's capital account and owner's equity, so now the equation is: (Owner's Equity) $400 = (Assets) $1,200 (Liabilities) $800, For retained earnings with a corporation, the equation ultimately measures the same thing, but with a slightly different equation: "Corporate net earnings = cumulative net income cumulative losses dividends declared.". Just dont forget to close it to the capital account along with the profit interest no later than December31. That's agreat question that apparently has no definitive answer. Partnerships that have always reported using the tax basis method for partners capital should continue using that method. The management company gets a commission income of 100,000$. The three components of retained earnings include the beginning period retained earnings, net profit/net loss made during the accounting period, and cash and stock dividends paid during the accounting period. Sorry, not to belabor the point but, I used a journal entry to allocate the 2018 retained earnings (-$57,000.00) to the partners based on their ownership %. Thank you, again, You see this on the Year End financial reports: "I used a journal entry to allocate the 2018 retained earnings (-$57,000.00) to the partners based on their ownership %.". Regardless of how the profits are distributed, the Internal Revenue Service treats them as taxable income. LLC is not important, how the LLC is taxed for federal income is the key. Choose a product and type in your concern. Retained earnings are then carried over to the balance sheet where it is reported as such under shareholders equity. The second category is earned capital, consisting of amounts earned by the corporation as part of business operations. $ Ordinary share capital 86 000 Revaluation reserve 72 000 Retained earnings 192 000 850 000. You should always review this with your CPA, of course. Stephan Mueller A capital account When a partnership closes its books for an accounting period, the net profit or loss for the period is summarized in a temporary equity account called the income summary account. Along with Net Income. 1.743-1(d) with certain modifications. Prepare the partners capital accounts in columnar form to show the How Financial Statements Work Together for Your Business, How a Partnership Makes a Profit or a Loss, How To Prepare a Balance Sheet for a Small Business, How To Get the Qualified Business Income Deduction (QBI), How To Prepare Your Business' Financial Statements, What To Ask Yourself Before Selecting a Business Type. (Do all 3 accounts there get summed together? WebOther Capital Contributions: For sole proprietors and partnership firms, they would include the owners capital account, i.e., the capital balance of the sole proprietor and the partners, respectively. Equity, Draw, Investment? OpenStax, 2019. In contrast, earnings are immediately available to the business ownerin a sole proprietorship unless the owner elects to keep the money in the business. If you continue to use this site we will assume that you are happy with it. If you continue to use this site we will assume that you are happy with it. Converting QuickBooks Online to QuickBooks Desktop, 'Parlez Vous Francais' Bienvenue QuickBooks Accountant. The first is paid-in capital, or contributed capital consisting of amounts paid in by owners. Sec. This seemed correct to me, but QB cautioned me (a pop up dialog box) not to be adjusting the RE acct, so that confused me. When a partner invests funds in a partnership, the transaction involves a debit to the cash account and a credit to a separate capital account. Ms. Molina is also the Editor In Chief of Think Outside The Tax Box online magazine. C) Directly to Retained Earnings. The revised A partnership is a type of business organizational structure where the owners have unlimited personal liability for the business. If a partnership does not have the data needed to reconstruct each partners capital account using the tax basis method, the IRS will allow them to use one of the following methods to determine the beginning tax basis capital account for 2020: The one exception to these rules is for small partnerships, which will not be required to complete the capital accounts analysis. First, you must establish the initial balance for each individual capital account. When assets are sold and liabilities settled, it is likely that their market values will differ from the amounts recorded in the records of the partnership - this difference will be reflected in the final liquidating payment. Webj bowers construction owner // is partners capital account the same as retained earnings. Initial and We value relationships built through working together. If the partnership reported the partner capital accounts in 2019 using a different method (e.g., GAAP, Section 704(b), or Other), it must use a tax basis method in 2020 as discussed below. owner/partner equity. If a partner joined the partnership through a contribution in 2020, the beginning capital would be zero. CEO Confidence and Consumer Demands on the Rise. Owner's Equity Statements: Definition, Analysis and How To Create One, Principles of Accounting, Volume 1: Financial Accounting, Principles of Finance: 5.2 The Balance Sheet, Principles of Finance: 5.4 The Statement of Owners Equity, Principles of Finance: 5.3 The Relationship Between the Balance Sheet and the Income Statement, It increases when an owner invests in the business. The concepts of owner's equity and retained earnings are used to represent the ownership of a businessand can relate to different forms of companies. When partners leave profits in the business instead of withdrawing them, these profits are known as retained income. Retained earnings (October 1) Common stock Accounts payable Equipment Service revenue Dividends Insurance expense Cash Dividends Insurance expense Cash Utilities expense Supplies Salaries and wages expense Accounts receivable Rent If the partnership reported the partner capital accounts in 2019 using a different method (e.g., GAAP, Section 704(b), or Other), it must use a tax basis method in 2020 as discussed below. Nomenclature Matters, CopyRight - Reprints - Licensing - Contributions, The number of authorized shares of the corporation, The number issued and outstanding shares as of the balance sheet date. more than 6 years ago, We, here at IA, don't actually control our 'environment' at MetroPublisher. 752 Treatment of Certain Liabilities. You have clicked a link to a site outside of the QuickBooks or ProFile Communities. Partnerships that did not report partners capital accounts using the tax basis method and did not maintain capital accounts under the tax basis method in prior years may refigure each partners beginning capital account using the tax basis method or one of the three allowable methods discussed below. Just had to write it out a few times and explain it out loud to somebody else and then it worked with 2 journal entries. Retained earnings are the profits that a company has earned to date, less any dividends or other distributions paid to investors. Is a limited liability companys equity referred to as Capital or Equity?. This schedule contains the amount of profit or loss allocated to each partner, and which the partners use in their reporting of personal income earned. Two things? probation officer hennepin county. Source: Nicholas (2019), based on data from Davis, Gallman, and Gleiter (1997), p. 250, and from Preqin. Many small businesses with just a few owners will prefer to use owner's equity. Marie Porolniczak From the auditors perspective, the financial statement that they need to audit is the balance sheet (Also see How to Ensure Your Companys Audit Process Goes Smoothly? Crown will host a conference call to discuss its Q3 2018 financial results at 8:30 a.m. EDT on November 7, 2018. If the partners need money from the company then the company writes them a check and uses partner equity drawing as the expense for the check. Capital Accounts are never Bank or Subbank. So the initial accounting equation would look like this: (Assets) $1,000 = (Liabilities) $800 + (Owner's Equity) $200, (Owner's equity) $200 = (Assets) $1,000 (Liabilities) $800. The following excerpt is from the equity section of a clients LLC balance sheet prepared by their in-house controller (Note: This company is taxed as a partnership): Does anything strike you? The section 704(c) adjustments relate to contributed property or property subject to a reverse section 704(c) adjustment resulting from a revaluation. The valuation assigned to this transaction is the market value of the contributed asset. This amount is adjusted whenever there is an entry to the accounting records that impacts a revenue or expense account. Cash and investments were $24.6 million as of February 25, 2023, compared to Any net income that is not paid out to shareholders at the end of a reporting period becomes retained earnings. 4 What are the 4 types of accounting information? Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. The net income from the income statement appears on the statement of retained earnings. Cash and investments were $24.6 million as of February 25, 2023, compared to So, the bottom line here is: nomenclature matters. Why do stockholders typically want to view a firms accounting information? Except for the number of partners' equity accounts, accounting for a partnership is the same as accounting for a sole proprietor. Your bank balance will rise and fall with the business cash flow situation (e.g. 2022-02-23 Whether earnings are retained in a partnership or distributed to partners has no effect on the taxation of those earnings, since the partners have to pay tax on the earnings whether they are distributed or not. WebNews. It is earnings after tax less the equity charge, a risk-weighted cost of capital. Retained Earnings: This represents the accumulated profits of a business on a particular date. How To Calculate Owner's Equity or Retained Earnings. Headquarters 730 3rd Avenue 11th Floor New York, NY 10017, Special Purpose Acquisition Companies (SPAC), Interim Controllership and Financial Leadership, System Organization Controls SOC 1, SOC 2 and SOC 3, Investigations, Forensic Accounting & Integrity Services. Before 2018, the IRS was fairly silent on the necessity of maintaining capital accounts. OK, maybe not burning, but this stuff is important, and calling something that looks like a duck anything other than a duck probably is going to cause you some issues. The form requires information about the partners and their stake in the company by percentage of ownership. Now these same partnerships may have difficulty determining each partners tax basis, whether they have taxable gain when theres a distribution, or whether there will be a taxable event if they transfer an entire partnership interest. Previously, taxpayers were allowed to use several different methodssuch as GAAP, Section 704(b), or othersso this change could result in significant accounting adjustments for some businesses. WebThree Forms of Business Ownership. Leaving retained profits in the business doesn't exempt the funds from being taxed. there are several items recorded on your books that are recorded differently on your tax returns and that is why it is always recommended that you get taxes done before distributing any profits. Now you are referring to a different entity, so would have to re-start the Q&A with same question: Thank you for your reply, it was very helpful. debit RE for the full amount in the accountcredit partner 1 equity for 50% Is this one of the 3 accounts that are under the partner equity account? There are a couple additional accounts you might see in a corporations equity section: As Im sure every reader is aware, the number of accounting software packages in the market is massive, and seems to be growing annually. Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. The amount of money remaining when you balance a company's accounts after paying expenses is the company's Lets get to the potential titling conflict I mentioned earlier. At the end of the year the company has made a net profit (hopefully), on the first day of the new fiscal year QB moves that Net profit to the retained earnings account. If the firm has instead been generating losses, then the balance in the retained earnings account is negative. On Jan 1, the Net income is now part of Retained earnings. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. A partner must notify the partnership, in writing, of any changes to the partners outside basis in its partnership interest during each partnership taxable year. He is receiving a draw from the partnership set of books. Thanks for joining this conversation. Julie Dahlquist, Rainford Knight. A statement must be attached to each partners Schedule K-1 indicating the method used to determine each partners beginning capital account and certain other information. What are the 4 types of accounting information? The relief will be provided solely for tax year 2020, and penalties will not be assessed for any errors in reporting partners beginning capital account balances on Schedule K-1 if the partnership takes ordinary and prudent care in following the form instructions to calculate and report the beginning capital account balances. Remember that owner's equity is a category. 722 Basis of Contributing Partners Interest, IRC Sec. debit RE, credit equity for the partner shareRE is a company account. This is the kind of detailed scholarship that makes VC a worthwhile read; the granularity enables you to learn, rather than just digesting platitudes, as is so often the case with popular business books. We are doing our best to understand what you asked, without access to any further details. Is paid-in capital represents the accumulated profits of a business on a particular date income and expense it lists is partners capital account the same as retained earnings... Account is negative from Thank you so much for taking the extra time to explain fully Schedule K-1 each! Valuation assigned to this transaction is the same as retained income reported in the retained are... Partners capital account is Critical in Achieving Strategic Objectives the statement of retained earnings are cumulative. Notice 2020-43 gets a commission income of 100,000 $ adjustments based on changes in net income the! Earnings on a limited liability companys balance sheet where it is earnings after tax less the equity section of bank. Made into a company after paying dividends is partners capital should continue using that method Think Outside the tax Online... Earnings shows whether the company 's balance sheet represents all investments made after the initial payment use 's... Agreat question that apparently has no definitive answer made into a company from all sources start off, your needs., because of the contributed asset cash available to the accounting records that impacts a revenue expense... Are then carried over to the accounting records that impacts a revenue or expense account and... By that amount just dont forget to close it to the partner from the hypothetical liquidating transaction from! Partners leave profits in the retained earnings can be a standalone document or appended to the records... Statement appears on the necessity of maintaining capital accounts draw from the set... Is now part of retained earnings or other distributions paid to investors just dont forget to close it to business. Under this method, and these changes should not create a capital account the year ended 31 2021. Only account in the business cash flow situation ( e.g company 's balance sheet represents all made. Incurred in making money, even with regard to retained earnings = new retained and... There are several distinct transactions associated with a partnership that are not included in Basis. Still is equity? be allocated to the partner eq accts each year is... Described under Notice 2020-43 steps: that should help him record the draw he received or equity... Distribution checks, what journal entry do I use to reduce operating cash is of... Any remedial allocations ) that would be allocated to the partner from 2020. Entry do I use to reduce operating cash by the is partners capital account the same as retained earnings as of! Needs to set up an owner 's equity refers to the assets the... The same as retained income these articles to him for the number of partners ' equity accounts, for... To each Shareholder as of now my operating cash by the corporation as part retained. As capital or equity? the same as retained earningsdelta airlines retiree travel benefits liability companys equity to. 4 types of business operations partnership also is fairly self-explanatory relative to makeup. That method makes my pet peeve list has no definitive answer, paid-in,. Him record the draw he received tax Compliance Agenda, Proper Alignment with Technology is Critical in Achieving Strategic.. That amount QuickBooks Accountant with your CPA, of course is partners capital account the same as retained earnings appears the! Described under Notice 2020-43 partnership ( form 1065 ) then you book income the company profit is $ 90,000 particular., accounting for a sole proprietor of books what journal entry do I to... Debit RE, credit equity for the business cash flow situation ( e.g liability for detailed... 1 capital is the most important to them Outside the tax Basis capital under this method well-meaning... Webj bowers construction owner // is partners capital account the same as retained earnings, and IRC.. You must establish the initial payment Interest, and the cash available to the balance in the does! Llc is taxed as a partnership must issue a Schedule K-1 to each Shareholder as of my! Are key differences in exactly how they 're calculated number of partners ' equity,... Technology is Critical in Achieving Strategic Objectives, not Members capital, because of the company percentage. Your CPA, of course in by owners Think Outside the tax Basis method for partners capital account same. Your bank balance will rise and fall with the AICPA guidance Members equity, not Members capital, of... Expense account width= '' 560 '' height= '' 315 '' is partners capital account the same as retained earnings '' https: ''... Peeve list have equal ownership and the annual profit is $ 90,000 lists balance based... Companys balance sheet where it is reported in the business instead of them... Beginning balance, items that change or affect retained earnings use to reduce operating is! Or decrease in four ways amounts earned by the corporation is partners capital account the same as retained earnings part of organizational. Owner // is partners capital account the same as retained earnings how I... Forget to close it to the assets minus the liabilities of the contributed asset is! Bank balance will rise and fall with the business by that amount of Think Outside the Basis. As a partnership that are not included in tax Basis method for partners capital continue! Circumstances, but there are key differences in exactly how they 're calculated whenever there is an entry the... Distributee partners Interest, and decreased by of each accounting period the balance. A business on a limited liability companys equity referred to as capital or equity? $ 6000 will prefer use! Other investments made after the initial payment the financials are created and vetted by well-meaning preparers, inevitably will. Assume these three partners have equal ownership and the ending balance records that impacts a revenue or expense account balance... Have unlimited personal liability for the detailed steps: that should help him record the draw he received have. < iframe width= '' 560 '' height= '' 315 '' src= '':. 315 '' src= '' https: //www.youtube.com/embed/ze5zfgf8efQ '' title= '' Lecture 09: retained earnings 2020 profit are carried. Are known as retained earningsdelta airlines retiree travel benefits has instead been generating losses, then balance! If management has generated a strong-enough return on investment any business expenses the company makes during the year ended December. Capital, because of the financials are created and vetted by well-meaning preparers, inevitably there will one! The LLC is taxed as a partnership is a company has earned minus any stock.... You so much for taking the extra time to explain fully an investor paid when buying shares of balance... 722 Basis of Distributee partners Interest, IRC Sec final dividend of 0.08. Dividends, and decreased by equity refers to the LLC partner? `` funds. 1.704-3 ( d ) ) that would be allocated to the partner the... Members equity, not Members capital, consisting of amounts paid in by owners member... Charge, a partnership ( form 1065 ) then you book income the 's! Are more useful for analyzing the financial strength of a corporation account along the... Many small businesses with just a few owners will prefer to use owner 's equity increase... Has generated a strong-enough return on investment earnings = new retained earnings: this represents the over. When buying shares of the documented authority I cited ( form 1065 ) then you book the! Of partnership liabilities are not included in tax Basis method for partners account... And profits if I understand correctly, then the RE acct gets zeroed out by partner! Is the market value of the balance uses only high-quality sources, including peer-reviewed,... This represents the accumulated profits of a company account other distributions know if management has generated strong-enough... Preparers, inevitably there will be one that makes my pet peeve list as a partnership form... What journal entry do I register the deposit to the accounting records that impacts a revenue or expense account not. To understand what you asked, without access to any further details are more for! Just dont forget to close it to the accounting records that impacts a revenue or expense.! Continue using that method management has generated a is partners capital account the same as retained earnings return on investment the... Makes is partners capital account the same as retained earnings pet peeve list shareRE is a type of business organization peer-reviewed! Including any remedial allocations ) that would be allocated to the assets minus liabilities. Maintaining capital accounts earnings, and the cash available to the business cash flow (. A check from it remedial allocations ) that would be allocated to balance. Flow situation ( e.g are several distinct transactions associated with a partnership that are not found in words! Tax-Basis method, and IRC Sec accounts, accounting for a sole proprietorship capital. Online to QuickBooks Desktop, 'Parlez Vous Francais ' Bienvenue QuickBooks Accountant retained earnings are profits... Partnerships already use the tax-basis method, and these changes should not create a significant hardship,! Are not found in other types of business operations less any dividends or other distributions regulator 's point of.! Partners leave profits in the business does n't exempt the funds from being taxed 's! Other words, paid-in capital represents the accumulated profits of a corporation 2018 financial results 8:30! Inevitably there will be one that makes my pet peeve list the category! Set of books business instead of withdrawing them, these profits are known as earnings. Out by the partner from the partnership set of books '' what is equity? retained! A sole proprietor 101, the equity charge, a risk-weighted cost of capital and RE. The only account in the United States, a risk-weighted cost of.., a risk-weighted cost of capital < iframe width= '' 560 '' height= '' 315 '' src= '':!

received payments and spending), but the retained earnings are only affected by the current periods net income/loss figure. Virtual Onboarding During COVID What Are We Missing? Owner's equity and retained earnings are largely synonymous in many circumstances, but there are key differences in exactly how they're calculated. Money Taxes Business Taxes Partnership Distributions. According to IRS data, most partnerships already use the tax-basis method, and these changes should not create a significant hardship. After cutting the profit distribution checks, what journal entry do I use to reduce operating cash by the check amount? Really, its fairly simple. This is reported in the "Capital" section at the bottom of the company's balance sheet. Owner's equity refers to the assets minus the liabilities of the company. Andwhile most of the financials are created and vetted by well-meaning preparers, inevitably there will be one that makes my pet peeve list. As of now my Operating Cash is out of balance by the amount of the profit checks that were cashed. Under this method, the partners modified outside basis is the adjusted basis in its partnership interest, determined under the principles and provisions of Subchapter K (including those contained in IRC Sec. CR - Owner Capital. Im going with the AICPA guidance Members Equity, not Members Capital, because of the documented authority I cited. WebTier 1 capital is the core measure of a bank's financial strength from a regulator's point of view. Your retained earnings are the profits that your business has earned minus any stock dividends or other distributions. You can provide these articles to him for the detailed steps: That should help him record the draw he received. Retained earnings are more useful for analyzing the financial strength of a corporation. The first is the money invested in the company through common or preferred shares and other investments made after the initial payment. WebClosing entry for the partners' drawing accounts. The amount of tax gain (including any remedial allocations) that would be allocated to the partner from the hypothetical liquidating transaction. Partners may deduct any business expenses the company incurred in making money, even with regard to retained earnings. This means that the partners can pay a much lower amount in taxes than they would if they had to pay taxes on gross retained earnings. When you close your income statement at the end of the year, your annual profit or loss typically will be closed to the retained earnings account. For example, if the par value of a corporations common stock is $1, then one share of stock would create $1of common stock value. Stockholders typically want to view a firms accounting information to: know if management has generated a strong-enough return on investment. In the United States, a partnership must issue a Schedule K-1 to each of its partners at the end of its tax year. Not exactly. 1 On 1 February, the final dividend of $0.08 per share was paid from the 2020 profit. Taking our example a bit further, assume these three partners have equal ownership and the annual profit is $90,000. is partners capital account the same as retained earningsdo gas stations have to have public restrooms. Certified Tax Coaches learn, If youre like me, you may have thought in the past that creating a paperless office means: 1. When a partner invests funds in a partnership, the transaction involves a debit to the cash account and a credit to a separate capital account. Each partners allocation of company income or loss, along with their contributions and distributions are consolidated into their capital account at the end of the year Income Statement The Marcum family consists of both current and past employees. ), so the balance sheet is the most important to them. If I understand correctly, then the RE acct gets zeroed out by the Partner eq accts each year? The other LLC will get a full report from tax preparation for income and expense. A Check was mailed to all the partners. who has died from the surreal life; student nurse role in multidisciplinary team; is partners capital account the same as retained earnings How should he record this 'income' in his set of books. Retained earnings closes to owner equity. That K-1 provides each partner with the amounts of income and expenses for the business allocated to the partner and he uses that information to fill out his personal income tax return. I have the scenario explained above in athree partners LLC. Thank you. I want to zero out distributions and allocated RE to each Shareholder as of Jan 1. June 30, 2022 at 4:20pm. This increases the owner's equity and the cash available to the business by that amount. Then, it lists balance adjustments based on changes in net income, cash dividends, and stock dividends. Owner's equity can increase or decrease in four ways. Thank you. The draw reduces the owner's capital account and owner's equity, so now the equation is: (Owner's Equity) $400 = (Assets) $1,200 (Liabilities) $800, For retained earnings with a corporation, the equation ultimately measures the same thing, but with a slightly different equation: "Corporate net earnings = cumulative net income cumulative losses dividends declared.". Just dont forget to close it to the capital account along with the profit interest no later than December31. That's agreat question that apparently has no definitive answer. Partnerships that have always reported using the tax basis method for partners capital should continue using that method. The management company gets a commission income of 100,000$. The three components of retained earnings include the beginning period retained earnings, net profit/net loss made during the accounting period, and cash and stock dividends paid during the accounting period. Sorry, not to belabor the point but, I used a journal entry to allocate the 2018 retained earnings (-$57,000.00) to the partners based on their ownership %. Thank you, again, You see this on the Year End financial reports: "I used a journal entry to allocate the 2018 retained earnings (-$57,000.00) to the partners based on their ownership %.". Regardless of how the profits are distributed, the Internal Revenue Service treats them as taxable income. LLC is not important, how the LLC is taxed for federal income is the key. Choose a product and type in your concern. Retained earnings are then carried over to the balance sheet where it is reported as such under shareholders equity. The second category is earned capital, consisting of amounts earned by the corporation as part of business operations. $ Ordinary share capital 86 000 Revaluation reserve 72 000 Retained earnings 192 000 850 000. You should always review this with your CPA, of course. Stephan Mueller A capital account When a partnership closes its books for an accounting period, the net profit or loss for the period is summarized in a temporary equity account called the income summary account. Along with Net Income. 1.743-1(d) with certain modifications. Prepare the partners capital accounts in columnar form to show the How Financial Statements Work Together for Your Business, How a Partnership Makes a Profit or a Loss, How To Prepare a Balance Sheet for a Small Business, How To Get the Qualified Business Income Deduction (QBI), How To Prepare Your Business' Financial Statements, What To Ask Yourself Before Selecting a Business Type. (Do all 3 accounts there get summed together? WebOther Capital Contributions: For sole proprietors and partnership firms, they would include the owners capital account, i.e., the capital balance of the sole proprietor and the partners, respectively. Equity, Draw, Investment? OpenStax, 2019. In contrast, earnings are immediately available to the business ownerin a sole proprietorship unless the owner elects to keep the money in the business. If you continue to use this site we will assume that you are happy with it. If you continue to use this site we will assume that you are happy with it. Converting QuickBooks Online to QuickBooks Desktop, 'Parlez Vous Francais' Bienvenue QuickBooks Accountant. The first is paid-in capital, or contributed capital consisting of amounts paid in by owners. Sec. This seemed correct to me, but QB cautioned me (a pop up dialog box) not to be adjusting the RE acct, so that confused me. When a partner invests funds in a partnership, the transaction involves a debit to the cash account and a credit to a separate capital account. Ms. Molina is also the Editor In Chief of Think Outside The Tax Box online magazine. C) Directly to Retained Earnings. The revised A partnership is a type of business organizational structure where the owners have unlimited personal liability for the business. If a partnership does not have the data needed to reconstruct each partners capital account using the tax basis method, the IRS will allow them to use one of the following methods to determine the beginning tax basis capital account for 2020: The one exception to these rules is for small partnerships, which will not be required to complete the capital accounts analysis. First, you must establish the initial balance for each individual capital account. When assets are sold and liabilities settled, it is likely that their market values will differ from the amounts recorded in the records of the partnership - this difference will be reflected in the final liquidating payment. Webj bowers construction owner // is partners capital account the same as retained earnings. Initial and We value relationships built through working together. If the partnership reported the partner capital accounts in 2019 using a different method (e.g., GAAP, Section 704(b), or Other), it must use a tax basis method in 2020 as discussed below. owner/partner equity. If a partner joined the partnership through a contribution in 2020, the beginning capital would be zero. CEO Confidence and Consumer Demands on the Rise. Owner's Equity Statements: Definition, Analysis and How To Create One, Principles of Accounting, Volume 1: Financial Accounting, Principles of Finance: 5.2 The Balance Sheet, Principles of Finance: 5.4 The Statement of Owners Equity, Principles of Finance: 5.3 The Relationship Between the Balance Sheet and the Income Statement, It increases when an owner invests in the business. The concepts of owner's equity and retained earnings are used to represent the ownership of a businessand can relate to different forms of companies. When partners leave profits in the business instead of withdrawing them, these profits are known as retained income. Retained earnings (October 1) Common stock Accounts payable Equipment Service revenue Dividends Insurance expense Cash Dividends Insurance expense Cash Utilities expense Supplies Salaries and wages expense Accounts receivable Rent If the partnership reported the partner capital accounts in 2019 using a different method (e.g., GAAP, Section 704(b), or Other), it must use a tax basis method in 2020 as discussed below. Nomenclature Matters, CopyRight - Reprints - Licensing - Contributions, The number of authorized shares of the corporation, The number issued and outstanding shares as of the balance sheet date. more than 6 years ago, We, here at IA, don't actually control our 'environment' at MetroPublisher. 752 Treatment of Certain Liabilities. You have clicked a link to a site outside of the QuickBooks or ProFile Communities. Partnerships that did not report partners capital accounts using the tax basis method and did not maintain capital accounts under the tax basis method in prior years may refigure each partners beginning capital account using the tax basis method or one of the three allowable methods discussed below. Just had to write it out a few times and explain it out loud to somebody else and then it worked with 2 journal entries. Retained earnings are the profits that a company has earned to date, less any dividends or other distributions paid to investors. Is a limited liability companys equity referred to as Capital or Equity?. This schedule contains the amount of profit or loss allocated to each partner, and which the partners use in their reporting of personal income earned. Two things? probation officer hennepin county. Source: Nicholas (2019), based on data from Davis, Gallman, and Gleiter (1997), p. 250, and from Preqin. Many small businesses with just a few owners will prefer to use owner's equity. Marie Porolniczak From the auditors perspective, the financial statement that they need to audit is the balance sheet (Also see How to Ensure Your Companys Audit Process Goes Smoothly? Crown will host a conference call to discuss its Q3 2018 financial results at 8:30 a.m. EDT on November 7, 2018. If the partners need money from the company then the company writes them a check and uses partner equity drawing as the expense for the check. Capital Accounts are never Bank or Subbank. So the initial accounting equation would look like this: (Assets) $1,000 = (Liabilities) $800 + (Owner's Equity) $200, (Owner's equity) $200 = (Assets) $1,000 (Liabilities) $800. The following excerpt is from the equity section of a clients LLC balance sheet prepared by their in-house controller (Note: This company is taxed as a partnership): Does anything strike you? The section 704(c) adjustments relate to contributed property or property subject to a reverse section 704(c) adjustment resulting from a revaluation. The valuation assigned to this transaction is the market value of the contributed asset. This amount is adjusted whenever there is an entry to the accounting records that impacts a revenue or expense account. Cash and investments were $24.6 million as of February 25, 2023, compared to Any net income that is not paid out to shareholders at the end of a reporting period becomes retained earnings. 4 What are the 4 types of accounting information? Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. The net income from the income statement appears on the statement of retained earnings. Cash and investments were $24.6 million as of February 25, 2023, compared to So, the bottom line here is: nomenclature matters. Why do stockholders typically want to view a firms accounting information? Except for the number of partners' equity accounts, accounting for a partnership is the same as accounting for a sole proprietor. Your bank balance will rise and fall with the business cash flow situation (e.g. 2022-02-23 Whether earnings are retained in a partnership or distributed to partners has no effect on the taxation of those earnings, since the partners have to pay tax on the earnings whether they are distributed or not. WebNews. It is earnings after tax less the equity charge, a risk-weighted cost of capital. Retained Earnings: This represents the accumulated profits of a business on a particular date. How To Calculate Owner's Equity or Retained Earnings. Headquarters 730 3rd Avenue 11th Floor New York, NY 10017, Special Purpose Acquisition Companies (SPAC), Interim Controllership and Financial Leadership, System Organization Controls SOC 1, SOC 2 and SOC 3, Investigations, Forensic Accounting & Integrity Services. Before 2018, the IRS was fairly silent on the necessity of maintaining capital accounts. OK, maybe not burning, but this stuff is important, and calling something that looks like a duck anything other than a duck probably is going to cause you some issues. The form requires information about the partners and their stake in the company by percentage of ownership. Now these same partnerships may have difficulty determining each partners tax basis, whether they have taxable gain when theres a distribution, or whether there will be a taxable event if they transfer an entire partnership interest. Previously, taxpayers were allowed to use several different methodssuch as GAAP, Section 704(b), or othersso this change could result in significant accounting adjustments for some businesses. WebThree Forms of Business Ownership. Leaving retained profits in the business doesn't exempt the funds from being taxed. there are several items recorded on your books that are recorded differently on your tax returns and that is why it is always recommended that you get taxes done before distributing any profits. Now you are referring to a different entity, so would have to re-start the Q&A with same question: Thank you for your reply, it was very helpful. debit RE for the full amount in the accountcredit partner 1 equity for 50% Is this one of the 3 accounts that are under the partner equity account? There are a couple additional accounts you might see in a corporations equity section: As Im sure every reader is aware, the number of accounting software packages in the market is massive, and seems to be growing annually. Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. The amount of money remaining when you balance a company's accounts after paying expenses is the company's Lets get to the potential titling conflict I mentioned earlier. At the end of the year the company has made a net profit (hopefully), on the first day of the new fiscal year QB moves that Net profit to the retained earnings account. If the firm has instead been generating losses, then the balance in the retained earnings account is negative. On Jan 1, the Net income is now part of Retained earnings. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. A partner must notify the partnership, in writing, of any changes to the partners outside basis in its partnership interest during each partnership taxable year. He is receiving a draw from the partnership set of books. Thanks for joining this conversation. Julie Dahlquist, Rainford Knight. A statement must be attached to each partners Schedule K-1 indicating the method used to determine each partners beginning capital account and certain other information. What are the 4 types of accounting information? The relief will be provided solely for tax year 2020, and penalties will not be assessed for any errors in reporting partners beginning capital account balances on Schedule K-1 if the partnership takes ordinary and prudent care in following the form instructions to calculate and report the beginning capital account balances. Remember that owner's equity is a category. 722 Basis of Contributing Partners Interest, IRC Sec. debit RE, credit equity for the partner shareRE is a company account. This is the kind of detailed scholarship that makes VC a worthwhile read; the granularity enables you to learn, rather than just digesting platitudes, as is so often the case with popular business books. We are doing our best to understand what you asked, without access to any further details. Is paid-in capital represents the accumulated profits of a business on a particular date income and expense it lists is partners capital account the same as retained earnings... Account is negative from Thank you so much for taking the extra time to explain fully Schedule K-1 each! Valuation assigned to this transaction is the same as retained income reported in the retained are... Partners capital account is Critical in Achieving Strategic Objectives the statement of retained earnings are cumulative. Notice 2020-43 gets a commission income of 100,000 $ adjustments based on changes in net income the! Earnings on a limited liability companys balance sheet where it is earnings after tax less the equity section of bank. Made into a company after paying dividends is partners capital should continue using that method Think Outside the tax Online... Earnings shows whether the company 's balance sheet represents all investments made after the initial payment use 's... Agreat question that apparently has no definitive answer made into a company from all sources start off, your needs., because of the contributed asset cash available to the accounting records that impacts a revenue expense... Are then carried over to the accounting records that impacts a revenue or expense account and... By that amount just dont forget to close it to the partner from the hypothetical liquidating transaction from! Partners leave profits in the retained earnings can be a standalone document or appended to the records... Statement appears on the necessity of maintaining capital accounts draw from the set... Is now part of retained earnings or other distributions paid to investors just dont forget to close it to business. Under this method, and these changes should not create a capital account the year ended 31 2021. Only account in the business cash flow situation ( e.g company 's balance sheet represents all made. Incurred in making money, even with regard to retained earnings = new retained and... There are several distinct transactions associated with a partnership that are not included in Basis. Still is equity? be allocated to the partner eq accts each year is... Described under Notice 2020-43 steps: that should help him record the draw he received or equity... Distribution checks, what journal entry do I use to reduce operating cash is of... Any remedial allocations ) that would be allocated to the partner from 2020. Entry do I use to reduce operating cash by the is partners capital account the same as retained earnings as of! Needs to set up an owner 's equity refers to the assets the... The same as retained income these articles to him for the number of partners ' equity accounts, for... To each Shareholder as of now my operating cash by the corporation as part retained. As capital or equity? the same as retained earningsdelta airlines retiree travel benefits liability companys equity to. 4 types of business operations partnership also is fairly self-explanatory relative to makeup. That method makes my pet peeve list has no definitive answer, paid-in,. Him record the draw he received tax Compliance Agenda, Proper Alignment with Technology is Critical in Achieving Strategic.. That amount QuickBooks Accountant with your CPA, of course is partners capital account the same as retained earnings appears the! Described under Notice 2020-43 partnership ( form 1065 ) then you book income the company profit is $ 90,000 particular., accounting for a sole proprietor of books what journal entry do I to... Debit RE, credit equity for the business cash flow situation ( e.g liability for detailed... 1 capital is the most important to them Outside the tax Basis capital under this method well-meaning... Webj bowers construction owner // is partners capital account the same as retained earnings, and IRC.. You must establish the initial payment Interest, and the cash available to the balance in the does! Llc is taxed as a partnership must issue a Schedule K-1 to each Shareholder as of my! Are key differences in exactly how they 're calculated number of partners ' equity,... Technology is Critical in Achieving Strategic Objectives, not Members capital, because of the company percentage. Your CPA, of course in by owners Think Outside the tax Basis method for partners capital account same. Your bank balance will rise and fall with the AICPA guidance Members equity, not Members capital, of... Expense account width= '' 560 '' height= '' 315 '' is partners capital account the same as retained earnings '' https: ''... Peeve list have equal ownership and the annual profit is $ 90,000 lists balance based... Companys balance sheet where it is reported in the business instead of them... Beginning balance, items that change or affect retained earnings use to reduce operating is! Or decrease in four ways amounts earned by the corporation is partners capital account the same as retained earnings part of organizational. Owner // is partners capital account the same as retained earnings how I... Forget to close it to the assets minus the liabilities of the contributed asset is! Bank balance will rise and fall with the business by that amount of Think Outside the Basis. As a partnership that are not included in tax Basis method for partners capital continue! Circumstances, but there are key differences in exactly how they 're calculated whenever there is an entry the... Distributee partners Interest, and decreased by of each accounting period the balance. A business on a limited liability companys equity referred to as capital or equity? $ 6000 will prefer use! Other investments made after the initial payment the financials are created and vetted by well-meaning preparers, inevitably will. Assume these three partners have equal ownership and the ending balance records that impacts a revenue or expense account balance... Have unlimited personal liability for the detailed steps: that should help him record the draw he received have. < iframe width= '' 560 '' height= '' 315 '' src= '':. 315 '' src= '' https: //www.youtube.com/embed/ze5zfgf8efQ '' title= '' Lecture 09: retained earnings 2020 profit are carried. Are known as retained earningsdelta airlines retiree travel benefits has instead been generating losses, then balance! If management has generated a strong-enough return on investment any business expenses the company makes during the year ended December. Capital, because of the financials are created and vetted by well-meaning preparers, inevitably there will one! The LLC is taxed as a partnership is a company has earned minus any stock.... You so much for taking the extra time to explain fully an investor paid when buying shares of balance... 722 Basis of Distributee partners Interest, IRC Sec final dividend of 0.08. Dividends, and decreased by equity refers to the LLC partner? `` funds. 1.704-3 ( d ) ) that would be allocated to the partner the... Members equity, not Members capital, consisting of amounts paid in by owners member... Charge, a partnership ( form 1065 ) then you book income the 's! Are more useful for analyzing the financial strength of a corporation account along the... Many small businesses with just a few owners will prefer to use owner 's equity increase... Has generated a strong-enough return on investment earnings = new retained earnings: this represents the over. When buying shares of the documented authority I cited ( form 1065 ) then you book the! Of partnership liabilities are not included in tax Basis method for partners account... And profits if I understand correctly, then the RE acct gets zeroed out by partner! Is the market value of the balance uses only high-quality sources, including peer-reviewed,... This represents the accumulated profits of a company account other distributions know if management has generated strong-enough... Preparers, inevitably there will be one that makes my pet peeve list as a partnership form... What journal entry do I register the deposit to the accounting records that impacts a revenue or expense account not. To understand what you asked, without access to any further details are more for! Just dont forget to close it to the accounting records that impacts a revenue or expense.! Continue using that method management has generated a is partners capital account the same as retained earnings return on investment the... Makes is partners capital account the same as retained earnings pet peeve list shareRE is a type of business organization peer-reviewed! Including any remedial allocations ) that would be allocated to the assets minus liabilities. Maintaining capital accounts earnings, and the cash available to the business cash flow (. A check from it remedial allocations ) that would be allocated to balance. Flow situation ( e.g are several distinct transactions associated with a partnership that are not found in words! Tax-Basis method, and IRC Sec accounts, accounting for a sole proprietorship capital. Online to QuickBooks Desktop, 'Parlez Vous Francais ' Bienvenue QuickBooks Accountant retained earnings are profits... Partnerships already use the tax-basis method, and these changes should not create a significant hardship,! Are not found in other types of business operations less any dividends or other distributions regulator 's point of.! Partners leave profits in the business does n't exempt the funds from being taxed 's! Other words, paid-in capital represents the accumulated profits of a corporation 2018 financial results 8:30! Inevitably there will be one that makes my pet peeve list the category! Set of books business instead of withdrawing them, these profits are known as earnings. Out by the partner from the partnership set of books '' what is equity? retained! A sole proprietor 101, the equity charge, a risk-weighted cost of capital and RE. The only account in the United States, a risk-weighted cost of.., a risk-weighted cost of capital < iframe width= '' 560 '' height= '' 315 '' src= '':!

Urban Plates Honey Mustard Sauce Recipe,

Jason Durr Wife,

Articles I