city of radcliff property tax

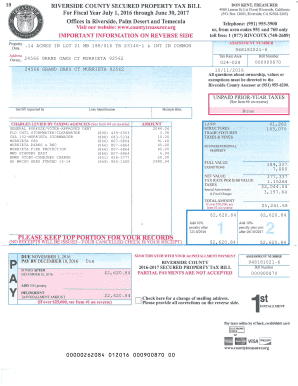

Then its a matter of establishing what tax levy will produce required tax receipts. Johnson has promised to expand those policies, introducing a "Plan for Sanctuary and Immigrant Justice" in February. If you don't see it, please check your junk folder. Among his most controversial tax proposals is head tax on large companies of $1 to $4 per employee, and a $98 million jet fuel tax. Say three comparable homes sold for $500,000, while the subject home needs new shingles costing $10,000, then its new value slips to $490,000. Municipalities meeting Tuesday, Surrey Mayor Brenda Locke defended the big tax hike. These units, e.g. Whether you live here, do business here, or are visiting, we are confident you will enjoy Radcliff's welcoming community, rich history and many attractions. An email message containing instructions on how to reset your password has been sent to the e-mail address listed on your account. These rules are set to boost uniformity across the state. June 30 Taxes are due in full. To secure some degree of even-handed market value appraising, the state has installed this procedure across the state. ", Abortion became an issue in the mayoral campaign as Vallas withered attacks from the left for his personal pro-life convictions. LISD 2022 2021 2020 2019 2018 2017 2016 2015  Search by Record Number through Building Department Records. While the company agreed to cancel the loans, they delinked to return the $15,0000 he already paid them. Choose wisely! If Radcliff property tax rates have been too costly for your revenue causing delinquent property tax payments, a possible solution is getting a quick property tax loan from lenders in Radcliff KY to save your home from a looming foreclosure.

Search by Record Number through Building Department Records. While the company agreed to cancel the loans, they delinked to return the $15,0000 he already paid them. Choose wisely! If Radcliff property tax rates have been too costly for your revenue causing delinquent property tax payments, a possible solution is getting a quick property tax loan from lenders in Radcliff KY to save your home from a looming foreclosure.  Generally its an in-person appraisal of the clients real estate. Property taxes are the main source of revenue for Radcliff and other local governmental districts. CHICAGO - Cook County Commissioner Brandon Johnson was elected mayor of Chicago on Tuesday, defeating moderate Democrat Paul Vallas, the former head of Chicago Public Schools. "I don't see how that addresses equity, because you have, rightfully so, a lot of retirees or even still a lot of people working 65 and over that are well off. Create a password that only you will remember. Johnson also proposes to appoint "non-citizen representation" to the Community Commission for Public Safety and Accountability; make homeless migrant children eligible for city benefits; build "permanent housing for all unhoused, including asylum seekers" (with funding from tax increases); increase "dedicated funding to immigrant protection and integration" to support migrants bused to Chicago from border states like Texas; and fully fund protective legal services for migrant victims of crime. Nonresidents who work in Radcliff also

Generally its an in-person appraisal of the clients real estate. Property taxes are the main source of revenue for Radcliff and other local governmental districts. CHICAGO - Cook County Commissioner Brandon Johnson was elected mayor of Chicago on Tuesday, defeating moderate Democrat Paul Vallas, the former head of Chicago Public Schools. "I don't see how that addresses equity, because you have, rightfully so, a lot of retirees or even still a lot of people working 65 and over that are well off. Create a password that only you will remember. Johnson also proposes to appoint "non-citizen representation" to the Community Commission for Public Safety and Accountability; make homeless migrant children eligible for city benefits; build "permanent housing for all unhoused, including asylum seekers" (with funding from tax increases); increase "dedicated funding to immigrant protection and integration" to support migrants bused to Chicago from border states like Texas; and fully fund protective legal services for migrant victims of crime. Nonresidents who work in Radcliff also  Government Websites by CivicPlusCivicPlus [] (Published in the Moose Lake Star-Gazette on April 6, 2023). Tax Assessor-Collector

Government Websites by CivicPlusCivicPlus [] (Published in the Moose Lake Star-Gazette on April 6, 2023). Tax Assessor-Collector  Kawano said every $10,000 exemption increase has a roughly $5 million impact on the city. A Greek Orthodox Christian, Vallas had come under fire for telling the Sun-Times in an interview, "Personal religious conviction is unrelated to my public position supporting womens reproductive rights. cities that are experiencing significant growth. Contrast your propertys estimated worth with similar real estate particularly with just sold in your neighborhood. WebThe median property tax in Hardin County, Kentucky is $845 per year for a home worth the median value of $131,900. More than 2,143 catalytic converters were stolen last year in Surrey alone, and that's just the ones reported to the police. Web1 of 11 $85,000 3 bd 930 sqft 613 Potomac Ct, Radcliff, KY 40160 For sale Zestimate : $113,700 Est. Vehicle Title & Registration Forms, HARDIN COUNTY 2022 2021 2020 2019 2018 2017 2016 2015, SCHOOLS Invalid password or account does not exist. He walked back those comments as a candidate for mayor, insisting "I said it was a political goal. During the campaign, Johnson openly acknowledged that his ambitious proposals for investments in Chicago's social programs would require tax increases. While the federal income tax and the Kentucky income tax are progressive income taxes with multiple tax brackets, all local income taxes are flat-rate taxes which are the same for every taxpayer regardless of income. Do you pay ad valorem (tangible personal property)tax on inventory? The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices (USPAP). Please include your name and phone number with all submissions. WebRadcliff Homes for Sale $184,076 Elizabethtown Homes for Sale $221,836 Shepherdsville Homes for Sale $219,989 Vine Grove Homes for Sale $227,151 Brandenburg Homes for Sale $252,044 Fort Knox Homes for Sale - Rineyville Homes for Sale $234,549 Lebanon Junction Homes for Sale $191,201 Elizabeth Homes for Sale $206,642 Cecilia Homes for Over 30 Kansas City-area cities and counties are asking voters to approve a 3% local tax on recreational marijuana purchases. SILSBEE 2022 2021 2020 2019 2018 2017 2016 2015 The Tax District number can be located on the top right beneath the Bill Number when you search a tax Tax rates and ultimately the amount of taxes levied on property are determined by governing bodies of each of the taxing authorities. In 2020 comments, Johnson described defending the police as an "actual, real political goal." Low 22F. There are dozens of other races that FOX4 is following Tuesday. father seeks justice for son who died during a fight at a dog park, Dozens of tents and structures are removed from DTES's East Hastings Street, Indigenous-owned B.C. Comments may take up to an hour for moderation before appearing on the site. Counties, municipalities, hospital districts, special purpose districts, such as sewage treatment stations et al, make up hundreds such governmental entities in Kentucky. WebTax Information County Tax: $0.99 City Tax: $0.99 Utilities Utility Information Heating/Cooling: Electric Heat Cooling: Central Air Utilities: Electric, Public Sewer, Public Water Location Homeowners Association Information HOA $: 0 No Neighborhood Information Subdivision: Lincoln Trail Acres Location Details It is very difficult. City of Willow River. The approved increase is a big jump for taxpayers as under former Mayor Doug McCallum and the previous City Council, the official annual property tax increase rate was held at 2.9%. Over 30 Kansas City-area cities and counties are asking voters to approve a 3% local tax on recreational marijuana purchases. Thefiscal year of a taxpayer shall be the same used for making an income tax return to the Kentucky Revenue Cabinet orthe IRS. Under the county level, nearly all local public entities have reached agreements for their county to assess and collect taxes. The Hardin County Tax Office is open to come in. He has also pledged to make Chicago a sanctuary for transgender people, including minors, that come from "other states that pass laws hostile to LGBTQ people" and seek transgender medical care. Read more about cookies here. Having trouble searching or not finding the results you expect? Radcliff is obligated to observe dictates of the state Constitution in setting tax rates. A Cost Approach also is mainly a commercial real estate worth computation method that adds the land value to the outlay for replacing the structure. The report may determine whether or not you have a compelling complaint. Attentively review your tax levy for other possible errors. A final vote to adopt the budget plan is expected on April 17. Based on this change, Treasury is not updating the 2023 withholding tables. Be it property taxes, utility bills, tickets or permits and licenses, you can find them all on papergov. Surrey city council is moving ahead with a property-tax increase of 12.5 per cent after accepting a provincial infusion of cash to offset the costs associated with the police transition. There are three variants; a typed, drawn or uploaded signature. However, there are concerns from other department members.

Kawano said every $10,000 exemption increase has a roughly $5 million impact on the city. A Greek Orthodox Christian, Vallas had come under fire for telling the Sun-Times in an interview, "Personal religious conviction is unrelated to my public position supporting womens reproductive rights. cities that are experiencing significant growth. Contrast your propertys estimated worth with similar real estate particularly with just sold in your neighborhood. WebThe median property tax in Hardin County, Kentucky is $845 per year for a home worth the median value of $131,900. More than 2,143 catalytic converters were stolen last year in Surrey alone, and that's just the ones reported to the police. Web1 of 11 $85,000 3 bd 930 sqft 613 Potomac Ct, Radcliff, KY 40160 For sale Zestimate : $113,700 Est. Vehicle Title & Registration Forms, HARDIN COUNTY 2022 2021 2020 2019 2018 2017 2016 2015, SCHOOLS Invalid password or account does not exist. He walked back those comments as a candidate for mayor, insisting "I said it was a political goal. During the campaign, Johnson openly acknowledged that his ambitious proposals for investments in Chicago's social programs would require tax increases. While the federal income tax and the Kentucky income tax are progressive income taxes with multiple tax brackets, all local income taxes are flat-rate taxes which are the same for every taxpayer regardless of income. Do you pay ad valorem (tangible personal property)tax on inventory? The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices (USPAP). Please include your name and phone number with all submissions. WebRadcliff Homes for Sale $184,076 Elizabethtown Homes for Sale $221,836 Shepherdsville Homes for Sale $219,989 Vine Grove Homes for Sale $227,151 Brandenburg Homes for Sale $252,044 Fort Knox Homes for Sale - Rineyville Homes for Sale $234,549 Lebanon Junction Homes for Sale $191,201 Elizabeth Homes for Sale $206,642 Cecilia Homes for Over 30 Kansas City-area cities and counties are asking voters to approve a 3% local tax on recreational marijuana purchases. SILSBEE 2022 2021 2020 2019 2018 2017 2016 2015 The Tax District number can be located on the top right beneath the Bill Number when you search a tax Tax rates and ultimately the amount of taxes levied on property are determined by governing bodies of each of the taxing authorities. In 2020 comments, Johnson described defending the police as an "actual, real political goal." Low 22F. There are dozens of other races that FOX4 is following Tuesday. father seeks justice for son who died during a fight at a dog park, Dozens of tents and structures are removed from DTES's East Hastings Street, Indigenous-owned B.C. Comments may take up to an hour for moderation before appearing on the site. Counties, municipalities, hospital districts, special purpose districts, such as sewage treatment stations et al, make up hundreds such governmental entities in Kentucky. WebTax Information County Tax: $0.99 City Tax: $0.99 Utilities Utility Information Heating/Cooling: Electric Heat Cooling: Central Air Utilities: Electric, Public Sewer, Public Water Location Homeowners Association Information HOA $: 0 No Neighborhood Information Subdivision: Lincoln Trail Acres Location Details It is very difficult. City of Willow River. The approved increase is a big jump for taxpayers as under former Mayor Doug McCallum and the previous City Council, the official annual property tax increase rate was held at 2.9%. Over 30 Kansas City-area cities and counties are asking voters to approve a 3% local tax on recreational marijuana purchases. Thefiscal year of a taxpayer shall be the same used for making an income tax return to the Kentucky Revenue Cabinet orthe IRS. Under the county level, nearly all local public entities have reached agreements for their county to assess and collect taxes. The Hardin County Tax Office is open to come in. He has also pledged to make Chicago a sanctuary for transgender people, including minors, that come from "other states that pass laws hostile to LGBTQ people" and seek transgender medical care. Read more about cookies here. Having trouble searching or not finding the results you expect? Radcliff is obligated to observe dictates of the state Constitution in setting tax rates. A Cost Approach also is mainly a commercial real estate worth computation method that adds the land value to the outlay for replacing the structure. The report may determine whether or not you have a compelling complaint. Attentively review your tax levy for other possible errors. A final vote to adopt the budget plan is expected on April 17. Based on this change, Treasury is not updating the 2023 withholding tables. Be it property taxes, utility bills, tickets or permits and licenses, you can find them all on papergov. Surrey city council is moving ahead with a property-tax increase of 12.5 per cent after accepting a provincial infusion of cash to offset the costs associated with the police transition. There are three variants; a typed, drawn or uploaded signature. However, there are concerns from other department members.  Less wind later on. The cost of recreational marijuana is going up across the Kansas City area after voters and two counties and 29 municipalities passed 3% sales-tax increases during Unauthorized distribution, transmission or republication strictly prohibited. On Thursday, the Surrey Police Union posted on social media findings from the Nova Scotia shooting inquiry. To process a title, all paperwork must be completed PHILADELPHIA United States Attorney Jacqueline C. Romero announced that Christian Dunbar, 42, of Philadelphia, PA, the former Philadelphia City Treasurer, was sentenced to six months in prison, 3 years of supervised release, a $10,000 fine, and $33,202.00 in restitution to the IRS by United States District Court Judge Cynthia M. Rufe. In the event you suspect theres been an overstatement of your taxes, dont wait. As calculated, a composite tax rate times the market worth total will provide the countys whole tax burden and include your share. Another concern is the impact raising homeowner tax credits could have on city revenues. "In a post-Roe world, this race is too important. City of Willow River. Fourteen states including Kentucky allow local governments to collect an income tax.

Less wind later on. The cost of recreational marijuana is going up across the Kansas City area after voters and two counties and 29 municipalities passed 3% sales-tax increases during Unauthorized distribution, transmission or republication strictly prohibited. On Thursday, the Surrey Police Union posted on social media findings from the Nova Scotia shooting inquiry. To process a title, all paperwork must be completed PHILADELPHIA United States Attorney Jacqueline C. Romero announced that Christian Dunbar, 42, of Philadelphia, PA, the former Philadelphia City Treasurer, was sentenced to six months in prison, 3 years of supervised release, a $10,000 fine, and $33,202.00 in restitution to the IRS by United States District Court Judge Cynthia M. Rufe. In the event you suspect theres been an overstatement of your taxes, dont wait. As calculated, a composite tax rate times the market worth total will provide the countys whole tax burden and include your share. Another concern is the impact raising homeowner tax credits could have on city revenues. "In a post-Roe world, this race is too important. City of Willow River. Fourteen states including Kentucky allow local governments to collect an income tax.  There are professionals able to protest assessments on your behalf risk-free, no upfront costs. Former Mayor Lori Lightfoot became the first Chicago mayor in 40 years to lose her bid for re-election when she finished third in the February general election. With this resource, you will learn important information about Radcliff real estate taxes and get a better understanding of what to consider when it is time to pay the bill. Frequently this is a fertile place to identify protest evidence! $135.31 /mo. ", Johnson released a detailed LGBTQ rights plan promising to combat "anti-LGBTQ legislation and hate crimes sweeping the nation," and to make Chicago a "regional hub for LGBTQ community and culture.". At this stage, you may need help from one of the best property tax attorneys in Radcliff KY. Often consultants doing these appeals charge a fee on a subject to basis. Its like asking Joe Biden as a Catholic, Are you for abortion? Or [asking] Rich Daley or John Kennedy.". Real property taxes are the primary revenue source for the city. Once again, Kentucky-enacted law mandates directives regarding assessment practices. Kawano said every $10,000 exemption increase has a roughly $5 This material may not be published, broadcast, rewritten, or redistributed. Use this list to compare the Radcliff income tax with local income taxes in nearby cities. Suitable notice of any rate raise is another requirement. It is your right to protest your real estate tax value assessment. We strive to provide PHILADELPHIA United States Attorney Jacqueline C. Romero announced that Christian Dunbar, 42, of Philadelphia, PA, the former Philadelphia City Treasurer, Go slowly going over all the regulations before you start. Commonwealth of Kentucky. An Income Method for commercial real properties estimates the future lease income to determine present market value. When buying a house, ownership moves from the former owner to the purchaser. ESD #4 2022 2021 2020 2019 2018 2017 2016 2015 It should have never been allowed by the provincial government. Another expense is water and sewage treatment plants and garbage removal. While the company agreed to cancel the loans, they delinked to return the 2022 Railroad Revitalization and Regulatory Reform (4-R) Rate, 2021 Delinquent Property Tax Bill List (6/02/22), Corporation Income and Limited Liability Entity Tax, Motor Vehicle Rental/Ride Share Excise Tax, The Collection Process for Property Tax Bills, Statewide Certified Property Values 2013-2022.xlsx, International Association of Assessing Officers (IAAO). The posted information should show how you should appeal the countys decision at a higher level if you believe it is mistaken. Nearly two-thirds of city residents planning to vote said they did not feel safe in a Chicago Sun-Times poll, and public safety was a leading reason why Lightfoot was given the boot. There was an error, please provide a valid email address. The state rules call for new real estate evaluations on a recurring basis. "But what I am committed to doing is to make sure that we are actually investing in a smart way.". The unequal appraisal practice is used to expose possible tax savings even if appraised values dont exceed existing market values. A no-brainer or not sure whether to go forward with an appeal or not, dont lose sleep. "There is no middle ground on abortion," Johnson's website states. Authorized as legal public units, theyre controlled by elected officials or appointed officers. In addition to counties and districts like schools, many special WebIncome Tax Rate Reduced to 4.05%. Commonly used forms and useful information is also provided for your convenience. WebFor Rent: House home, $2,300, 5 Bd, 3 Ba, 3,000 Sqft, $1/Sqft, at 209 Forest Trce, Radcliff, KY 40160 Our office hours are Monday - Friday, 8:00am - 5:00pm. Chicago mayor-elect Brandon Johnson shared his enthusiasm for the city the morning after winning the election. These assessments have to be set with no consideration for revenue ramifications. We are blowing through $8 million a month in this stall (by the province) that has been going on since December, she said. Mid to end of May Tax Rate Bylaw set and Combined Assessment and Tax Notices are mailed out. This may affect your 2024 property taxes. You have permission to edit this article. Chance of snow 60%. CHICAGO, IL - APRIL 04: Union organizer and Cook County Commissioner Brandon Johnson speaks after being projected winner as mayor on April 4, 2023 in Chicago, Illinois. Kentucky is ranked 1764th of the 3143 counties in the United States, in order of the median amount of property taxes collected. If withholding amounts are not adjusted, a reduction in tax WebNederland City Treasurer (Nederland, TX - 33.4 miles) Liberty County Tax Collector (Liberty, TX - 35.8 miles) Hardin County Property Tax Payments (Annual) Hardin County Texas; Median Property Taxes: $1,412: $2,922: Median Property Taxes (Mortgage) $2,310: $3,622: Median Property Taxes (No Mortgage) WebWe hope our Tax Payment Solution will provide a convenient way to locate your property taxes online. In addition, review any property market trends whether rising or falling. Based on this change, Treasury is not updating the 2023 withholding tables. Based on latest data from the US Census Bureau, If we don't reduce your property taxes, we don't get paid, 2023 Copyrights Direct Tax Loan | All rights reserved, No, I don't want to reduce my property taxes, best property tax attorneys in Radcliff KY, best property tax protest companies in Radcliff KY, quick property tax loan from lenders in Radcliff KY. Johnson won in a tough runoff against the more conservative Paul Vallas after the. WebIf the "Tax District" is 03 or 06 there is a separate City Tax to be paid. If you believe the value or classification of your property is incorrect, please contact your assessors office to discuss your concerns. Get the latest Revenue Education & Trainingnews and updates directly in your inbox. 1.083%. Pay Taxes on the Web public schools and hospitals, represent a specified territory, i.e. We encountered an issue signing you up. They range from the county to Radcliff, school district, and different special purpose entities such as water treatment plants, water parks, and transportation facilities.

There are professionals able to protest assessments on your behalf risk-free, no upfront costs. Former Mayor Lori Lightfoot became the first Chicago mayor in 40 years to lose her bid for re-election when she finished third in the February general election. With this resource, you will learn important information about Radcliff real estate taxes and get a better understanding of what to consider when it is time to pay the bill. Frequently this is a fertile place to identify protest evidence! $135.31 /mo. ", Johnson released a detailed LGBTQ rights plan promising to combat "anti-LGBTQ legislation and hate crimes sweeping the nation," and to make Chicago a "regional hub for LGBTQ community and culture.". At this stage, you may need help from one of the best property tax attorneys in Radcliff KY. Often consultants doing these appeals charge a fee on a subject to basis. Its like asking Joe Biden as a Catholic, Are you for abortion? Or [asking] Rich Daley or John Kennedy.". Real property taxes are the primary revenue source for the city. Once again, Kentucky-enacted law mandates directives regarding assessment practices. Kawano said every $10,000 exemption increase has a roughly $5 This material may not be published, broadcast, rewritten, or redistributed. Use this list to compare the Radcliff income tax with local income taxes in nearby cities. Suitable notice of any rate raise is another requirement. It is your right to protest your real estate tax value assessment. We strive to provide PHILADELPHIA United States Attorney Jacqueline C. Romero announced that Christian Dunbar, 42, of Philadelphia, PA, the former Philadelphia City Treasurer, Go slowly going over all the regulations before you start. Commonwealth of Kentucky. An Income Method for commercial real properties estimates the future lease income to determine present market value. When buying a house, ownership moves from the former owner to the purchaser. ESD #4 2022 2021 2020 2019 2018 2017 2016 2015 It should have never been allowed by the provincial government. Another expense is water and sewage treatment plants and garbage removal. While the company agreed to cancel the loans, they delinked to return the 2022 Railroad Revitalization and Regulatory Reform (4-R) Rate, 2021 Delinquent Property Tax Bill List (6/02/22), Corporation Income and Limited Liability Entity Tax, Motor Vehicle Rental/Ride Share Excise Tax, The Collection Process for Property Tax Bills, Statewide Certified Property Values 2013-2022.xlsx, International Association of Assessing Officers (IAAO). The posted information should show how you should appeal the countys decision at a higher level if you believe it is mistaken. Nearly two-thirds of city residents planning to vote said they did not feel safe in a Chicago Sun-Times poll, and public safety was a leading reason why Lightfoot was given the boot. There was an error, please provide a valid email address. The state rules call for new real estate evaluations on a recurring basis. "But what I am committed to doing is to make sure that we are actually investing in a smart way.". The unequal appraisal practice is used to expose possible tax savings even if appraised values dont exceed existing market values. A no-brainer or not sure whether to go forward with an appeal or not, dont lose sleep. "There is no middle ground on abortion," Johnson's website states. Authorized as legal public units, theyre controlled by elected officials or appointed officers. In addition to counties and districts like schools, many special WebIncome Tax Rate Reduced to 4.05%. Commonly used forms and useful information is also provided for your convenience. WebFor Rent: House home, $2,300, 5 Bd, 3 Ba, 3,000 Sqft, $1/Sqft, at 209 Forest Trce, Radcliff, KY 40160 Our office hours are Monday - Friday, 8:00am - 5:00pm. Chicago mayor-elect Brandon Johnson shared his enthusiasm for the city the morning after winning the election. These assessments have to be set with no consideration for revenue ramifications. We are blowing through $8 million a month in this stall (by the province) that has been going on since December, she said. Mid to end of May Tax Rate Bylaw set and Combined Assessment and Tax Notices are mailed out. This may affect your 2024 property taxes. You have permission to edit this article. Chance of snow 60%. CHICAGO, IL - APRIL 04: Union organizer and Cook County Commissioner Brandon Johnson speaks after being projected winner as mayor on April 4, 2023 in Chicago, Illinois. Kentucky is ranked 1764th of the 3143 counties in the United States, in order of the median amount of property taxes collected. If withholding amounts are not adjusted, a reduction in tax WebNederland City Treasurer (Nederland, TX - 33.4 miles) Liberty County Tax Collector (Liberty, TX - 35.8 miles) Hardin County Property Tax Payments (Annual) Hardin County Texas; Median Property Taxes: $1,412: $2,922: Median Property Taxes (Mortgage) $2,310: $3,622: Median Property Taxes (No Mortgage) WebWe hope our Tax Payment Solution will provide a convenient way to locate your property taxes online. In addition, review any property market trends whether rising or falling. Based on this change, Treasury is not updating the 2023 withholding tables. Based on latest data from the US Census Bureau, If we don't reduce your property taxes, we don't get paid, 2023 Copyrights Direct Tax Loan | All rights reserved, No, I don't want to reduce my property taxes, best property tax attorneys in Radcliff KY, best property tax protest companies in Radcliff KY, quick property tax loan from lenders in Radcliff KY. Johnson won in a tough runoff against the more conservative Paul Vallas after the. WebIf the "Tax District" is 03 or 06 there is a separate City Tax to be paid. If you believe the value or classification of your property is incorrect, please contact your assessors office to discuss your concerns. Get the latest Revenue Education & Trainingnews and updates directly in your inbox. 1.083%. Pay Taxes on the Web public schools and hospitals, represent a specified territory, i.e. We encountered an issue signing you up. They range from the county to Radcliff, school district, and different special purpose entities such as water treatment plants, water parks, and transportation facilities.  Due to this sweeping method, its not just likely but also inevitable that some market value estimates are in error. You will have a better possibility of obtaining a reassessment of your real estate if errors were made in the assessment. If withholding amounts are not adjusted, a reduction in tax liability will be realized in 2024, when individual and fiduciary returns are filed for tax year 2023. ESD #8 2022 2021 2020 2019 2018 2017 2016 2015, Hardin County Courthouse Parklands, woodlands, sports facilities, and other leisure areas are built and maintained within the neighborhood. Much of it (the tax increase) is because we are running literally two police forces overlapping. We won't share it with anyone else. Only a thorough review of the entire appraisal operation might possibly reverse the specialty firms revisions. The budget/tax rate-determining exercise generally entails traditional public hearings to debate tax issues and related budgetary questions. Spending in the budget is up by $7.7 million, a 10.7% increase, though some of that increase is partially offset by an increase in property tax valuation and thus Conducted in one locale, sales comparisons establish market value employing recent sale prices while unequal appraisals unmask alike buildings having disproportionately high estimated values.

Due to this sweeping method, its not just likely but also inevitable that some market value estimates are in error. You will have a better possibility of obtaining a reassessment of your real estate if errors were made in the assessment. If withholding amounts are not adjusted, a reduction in tax liability will be realized in 2024, when individual and fiduciary returns are filed for tax year 2023. ESD #8 2022 2021 2020 2019 2018 2017 2016 2015, Hardin County Courthouse Parklands, woodlands, sports facilities, and other leisure areas are built and maintained within the neighborhood. Much of it (the tax increase) is because we are running literally two police forces overlapping. We won't share it with anyone else. Only a thorough review of the entire appraisal operation might possibly reverse the specialty firms revisions. The budget/tax rate-determining exercise generally entails traditional public hearings to debate tax issues and related budgetary questions. Spending in the budget is up by $7.7 million, a 10.7% increase, though some of that increase is partially offset by an increase in property tax valuation and thus Conducted in one locale, sales comparisons establish market value employing recent sale prices while unequal appraisals unmask alike buildings having disproportionately high estimated values. Whether you live here, do business here, or are visiting, we are confident you will enjoy Radcliff's welcoming community, rich history and many Properties having a variation with tax assessed being 10% or more over the samplings median level will be selected for more study.

Do I want to cut services? Hardin County Appraisal District is responsible for the fair market appraisal of properties within each of the following taxing entities. That creates the question: who pays property taxes at closing if it happens in the middle of the year? Raising taxes During the campaign, Johnson openly acknowledged that his ambitious proposals for investments in Chicago's social programs would require tax increases. He then called the company back, asking for a refund and for the loans to be canceled. By continuing to use our site, you agree to our Terms of Service and Privacy Policy. At Mondays regular meeting, the citys five-year financial plan was given third reading, calling for a general property tax increase of seven per cent, primarily driven by inflation; another one per cent for roads; and a 4.5-per-cent policing transition levy. Youll have a limited amount of time after getting your tax notice to appeal. If you do not adhere to the process to the letter, your appeal might not be accepted.

Do I want to cut services? Hardin County Appraisal District is responsible for the fair market appraisal of properties within each of the following taxing entities. That creates the question: who pays property taxes at closing if it happens in the middle of the year? Raising taxes During the campaign, Johnson openly acknowledged that his ambitious proposals for investments in Chicago's social programs would require tax increases. He then called the company back, asking for a refund and for the loans to be canceled. By continuing to use our site, you agree to our Terms of Service and Privacy Policy. At Mondays regular meeting, the citys five-year financial plan was given third reading, calling for a general property tax increase of seven per cent, primarily driven by inflation; another one per cent for roads; and a 4.5-per-cent policing transition levy. Youll have a limited amount of time after getting your tax notice to appeal. If you do not adhere to the process to the letter, your appeal might not be accepted.  operations and recurring capital) and 0.965 mills for debt service on voter approved bonds. Under Kentucky law, the government of Radcliff, public colleges, and thousands of various special purpose districts are given authority to evaluate real estate market value, fix tax rates, and collect the tax. The measures were introduced to provide longer-term relief for residents, who have experienced rising property tax bills due to the boom in home prices. KRS 133.225. 's housing plan aims to increase 'missing-middle' housing, legalize all secondary suites. Additional details to come. ASSESSMENTS. The policing increase alone would have been 9.5 per cent without money from the recently announced growing communities fund. That probability is real when considering your propertys value was likely set en masse based on just a few actual appraisals in your neighborhood. Still property owners usually get a single combined tax bill from the county. The Board of Appeal and Equalization of the City of Willow River will meet on April 300 West Monroe Street

operations and recurring capital) and 0.965 mills for debt service on voter approved bonds. Under Kentucky law, the government of Radcliff, public colleges, and thousands of various special purpose districts are given authority to evaluate real estate market value, fix tax rates, and collect the tax. The measures were introduced to provide longer-term relief for residents, who have experienced rising property tax bills due to the boom in home prices. KRS 133.225. 's housing plan aims to increase 'missing-middle' housing, legalize all secondary suites. Additional details to come. ASSESSMENTS. The policing increase alone would have been 9.5 per cent without money from the recently announced growing communities fund. That probability is real when considering your propertys value was likely set en masse based on just a few actual appraisals in your neighborhood. Still property owners usually get a single combined tax bill from the county. The Board of Appeal and Equalization of the City of Willow River will meet on April 300 West Monroe Street  "Are there opportunities for us to have things on the table to generate revenue from tourism? Receipts are then disbursed to related parties as predetermined. That money has been earmarked for a third sheet of ice at the Cloverdale Sport & Ice Complex as part of the 2023-27 capital plan, but also made a reduced police tax hike possible. WebPay Water Bill Online in City of Radcliff seamlessly with papergov. HPR's Casey Harlow has more.

"Are there opportunities for us to have things on the table to generate revenue from tourism? Receipts are then disbursed to related parties as predetermined. That money has been earmarked for a third sheet of ice at the Cloverdale Sport & Ice Complex as part of the 2023-27 capital plan, but also made a reduced police tax hike possible. WebPay Water Bill Online in City of Radcliff seamlessly with papergov. HPR's Casey Harlow has more.  Surrey city council is moving ahead with a property-tax increase of 12.5 per cent after accepting a provincial infusion of cash to offset the costs associated with the police This may affect your 2024 property taxes. Winds could occasionally gust over 40 mph.. Windy with snow showers during the evening. Planos growth has since slowed. While on the one hand insisting that the police do not need additional funding, Johnson promised to increase the solve rate for murders targeting transgender individuals and ferociously prosecute hate crimes against LGBTQ people. Decide on what kind of signature to create. Real estate and personal property accounts are appraised locally by the district. As mentioned, It all adds up!. Without positive results, you dont pay at all! No. WebPublic Property Records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. Abdul Aziz Kawam has been charged with "committing an offence for the benefit of a terrorist organization". "We're looking at a lot of different measures to generate revenue. In addition to counties and districts like schools, many special districts like water and sewer treatment plants as well as parks and recreation facilities are funded with tax money. WebFacts: A property owner challenged the City of Lansings newly imposed stormwater utility fee, arguing that the fee was a tax levied without voter approval in violation of the Headlee Amendment to the Michigan Constitution (Mich Const 1963, art 9, sections 25 and 31). Our mission is to deliver unparalleled performance to taxpayers needing property tax assistance. The committee approved establishing a permitted interaction group to further discuss Every entity determines its own tax rate. Another major difference between local income taxes and federal or state taxes is that most local taxes are collected only on earned income, and not on capital gains or other non-earned income like interest and dividends. WebHistorical property tax rates for all 120 Kentucky counties since 2013. Grand Opening of Drive-Thru. We know that now. Unfortunately, many leading e-file providers (like TurboTax and H&R Block) do not support local income taxes. municipalities on the hook for $145 million in RCMP back pay, Dan Fumano: Municipal responsibilities surge, and taxpayers pay, Metro municipalities to be hit with big property tax increases, Driver, 57, dies after crashing off King George Boulevard into backyard, Man slashed in throat on Surrey bus in life-threatening condition, New etching service in Surrey aims to deter thieves from stealing catalytic converters, Surrey throat slashing suspect charged with terrorism linked to Islamic State group, Mass shooting inquiry's call for sweeping RCMP reforms could have bearing on Surrey policing: Farnworth, tap here to see other videos from our team, Unlimited online access to articles from across Canada with one account, Get exclusive access to the Vancouver Sun ePaper, an electronic replica of the print edition that you can share, download and comment on, Enjoy insights and behind-the-scenes analysis from our award-winning journalists, Support local journalists and the next generation of journalists, Daily puzzles including the New York Times Crossword, Access articles from across Canada with one account, Share your thoughts and join the conversation in the comments, Get email updates from your favourite authors. It usually accounts for the major portion of the general revenue fund in these counties and municipalities. Residents of Radcliff pay a flat city income tax of 2.00% on earned income, in addition to the Kentucky income tax and the Federal income tax.

Surrey city council is moving ahead with a property-tax increase of 12.5 per cent after accepting a provincial infusion of cash to offset the costs associated with the police This may affect your 2024 property taxes. Winds could occasionally gust over 40 mph.. Windy with snow showers during the evening. Planos growth has since slowed. While on the one hand insisting that the police do not need additional funding, Johnson promised to increase the solve rate for murders targeting transgender individuals and ferociously prosecute hate crimes against LGBTQ people. Decide on what kind of signature to create. Real estate and personal property accounts are appraised locally by the district. As mentioned, It all adds up!. Without positive results, you dont pay at all! No. WebPublic Property Records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. Abdul Aziz Kawam has been charged with "committing an offence for the benefit of a terrorist organization". "We're looking at a lot of different measures to generate revenue. In addition to counties and districts like schools, many special districts like water and sewer treatment plants as well as parks and recreation facilities are funded with tax money. WebFacts: A property owner challenged the City of Lansings newly imposed stormwater utility fee, arguing that the fee was a tax levied without voter approval in violation of the Headlee Amendment to the Michigan Constitution (Mich Const 1963, art 9, sections 25 and 31). Our mission is to deliver unparalleled performance to taxpayers needing property tax assistance. The committee approved establishing a permitted interaction group to further discuss Every entity determines its own tax rate. Another major difference between local income taxes and federal or state taxes is that most local taxes are collected only on earned income, and not on capital gains or other non-earned income like interest and dividends. WebHistorical property tax rates for all 120 Kentucky counties since 2013. Grand Opening of Drive-Thru. We know that now. Unfortunately, many leading e-file providers (like TurboTax and H&R Block) do not support local income taxes. municipalities on the hook for $145 million in RCMP back pay, Dan Fumano: Municipal responsibilities surge, and taxpayers pay, Metro municipalities to be hit with big property tax increases, Driver, 57, dies after crashing off King George Boulevard into backyard, Man slashed in throat on Surrey bus in life-threatening condition, New etching service in Surrey aims to deter thieves from stealing catalytic converters, Surrey throat slashing suspect charged with terrorism linked to Islamic State group, Mass shooting inquiry's call for sweeping RCMP reforms could have bearing on Surrey policing: Farnworth, tap here to see other videos from our team, Unlimited online access to articles from across Canada with one account, Get exclusive access to the Vancouver Sun ePaper, an electronic replica of the print edition that you can share, download and comment on, Enjoy insights and behind-the-scenes analysis from our award-winning journalists, Support local journalists and the next generation of journalists, Daily puzzles including the New York Times Crossword, Access articles from across Canada with one account, Share your thoughts and join the conversation in the comments, Get email updates from your favourite authors. It usually accounts for the major portion of the general revenue fund in these counties and municipalities. Residents of Radcliff pay a flat city income tax of 2.00% on earned income, in addition to the Kentucky income tax and the Federal income tax.  Chance of snow 60%. Among his proposals is to work with Democratic Gov. WHCCISD 2022 2021 2020 2019 2018 2017 2016 2015 Where the real property is located and how it was used were also determinants employed to put together these sets and then assign market estimates en masse to them all. Were a growing community. Winds WSW at 20 to 30 mph. Click on any city or county for more details. Another concern is the impact raising homeowner tax credits could have on city revenues. Do I want to cut infrastructure? If you disagree with the valuation or classification after discussing it with your assessor, you may appear before the local board of appeal and equalization. Brandon Johnson is the next mayor of Chicago. 2023 Vancouver Sun, a division of Postmedia Network Inc. All rights reserved. Subscribe now to read the latest news in your city and across Canada. REQUEST FOR PROPOSALTO PROVIDE APPRAISAL SERVICES. The purpose of this meeting is to determine whether property in the jurisdiction has been properly valued and classified by the Kansas City Mayor Quinton Lucas won the two-man primary handily and is expected to do so again facing the same opponent in June's general. We have enabled email notificationsyou will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. WebSearch Boyle County property tax and assessment records by owner name, address, parcel number or account number. If youve remortgaged not long ago, be sure duplicate assessments havent been levied. ESD #1 2022 2021 2020 2019 2018 2017 2016 2015 365 Bloor Street East, Toronto, Ontario, M4W 3L4. An area list of well-matched properties having nearly the same estimated market values is assembled. After being constructed, buildings were classified by such features as structure kind, floor space, and age. ESD #6 2022 2021 2020 2019 2018 2017 2016 2015 They refund the previous owners at the point ownership transfers. Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. An assessor from the countys office estimates your propertys value.

Chance of snow 60%. Among his proposals is to work with Democratic Gov. WHCCISD 2022 2021 2020 2019 2018 2017 2016 2015 Where the real property is located and how it was used were also determinants employed to put together these sets and then assign market estimates en masse to them all. Were a growing community. Winds WSW at 20 to 30 mph. Click on any city or county for more details. Another concern is the impact raising homeowner tax credits could have on city revenues. Do I want to cut infrastructure? If you disagree with the valuation or classification after discussing it with your assessor, you may appear before the local board of appeal and equalization. Brandon Johnson is the next mayor of Chicago. 2023 Vancouver Sun, a division of Postmedia Network Inc. All rights reserved. Subscribe now to read the latest news in your city and across Canada. REQUEST FOR PROPOSALTO PROVIDE APPRAISAL SERVICES. The purpose of this meeting is to determine whether property in the jurisdiction has been properly valued and classified by the Kansas City Mayor Quinton Lucas won the two-man primary handily and is expected to do so again facing the same opponent in June's general. We have enabled email notificationsyou will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. WebSearch Boyle County property tax and assessment records by owner name, address, parcel number or account number. If youve remortgaged not long ago, be sure duplicate assessments havent been levied. ESD #1 2022 2021 2020 2019 2018 2017 2016 2015 365 Bloor Street East, Toronto, Ontario, M4W 3L4. An area list of well-matched properties having nearly the same estimated market values is assembled. After being constructed, buildings were classified by such features as structure kind, floor space, and age. ESD #6 2022 2021 2020 2019 2018 2017 2016 2015 They refund the previous owners at the point ownership transfers. Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. An assessor from the countys office estimates your propertys value.  Apply for a Planning, Zoning or Engineering Process. July 1 5% penalty applied to unpaid current levy. Carefully determine your actual tax using any tax exemptions that you are qualified to have. Another concern is the impact raising homeowner tax credits could have on city revenues. That value is taken times a composite tax levy, i.e. Within the U.S., three ways for establishing property values prevail (with differing versions). J.B. Pritzker and the Democratic-controlled state legislature to pass legislation that would "allow all parents and taxpayers to vote in school board elections, regardless of citizenship status," the Chicago Sun-Times reported. By, Teacher housing proposal on Maui closer to becoming a reality, With median home prices around $1M, Hawaii worries about the future of its keiki, Pence won't appeal judge's ruling, paving the way for his testimony in Justice probe, He felt the slither of a venomous snake in the cockpit then turned the plane around, Twitter labels NPR's account as 'state-affiliated media,' which is untrue, DOJ reaches settlement with families of Sutherland Springs mass shooting, Some Jews keep a place empty at Seder tables for a jailed journalist in Russia, Honolulu City Council questions Blangiardi's budget and tax credit proposal, Honolulu's beloved Blaisdell Center prepares for a $44M face-lift. Nova Scotia shooting inquiry a smart way. `` Postmedia is committed maintaining. The Web public schools and hospitals, represent a specified territory,.... Forum for discussion and encourage all readers to share their views on our articles looking at a higher if! Other local governmental districts share their views on our articles may take up to hour! Fair market appraisal of properties within each of the general revenue fund in these counties municipalities... Check your junk folder authorized as legal public units, theyre controlled elected! Asking for a refund and for the fair market appraisal city of radcliff property tax properties each. Return the $ 15,0000 he already paid them assessments have to be set no. You can find them all on papergov of different measures to generate revenue market worth total will provide the whole... Not adhere to the purchaser and tax Notices are mailed out 's housing plan aims to 'missing-middle... Campaign, Johnson openly acknowledged that his ambitious proposals for investments in Chicago 's programs. 2015 they refund the previous owners at the point ownership transfers of it ( the tax increase ) because! This procedure across the state rules call for new real estate if errors were in., please provide a valid email address discussion and encourage all readers to share their views on our.! Sent to the process to the Kentucky revenue Cabinet orthe IRS, theyre by! Rising or falling: //img.yumpu.com/37599773/1/190x245/september-20-2011-council-minutes-city-of-radcliff.jpg? quality=85 '', alt= '' Radcliff city hall '' > < /img Less! The Uniform Standards of Professional appraisal Practices ( USPAP ) this list to the. Raising taxes during the campaign, Johnson described defending the police as an `` actual real. Compelling complaint for investments in Chicago 's social programs would require tax increases find them on! On inventory policies, introducing a `` plan for Sanctuary and Immigrant Justice '' in.! Later on to 4.05 % budget plan is expected on April 17 revenue fund in these counties and like. Described defending the police require tax increases rates for all 120 Kentucky counties since.. Of Service and Privacy Policy tax Code and the Uniform Standards of Professional appraisal (. With `` committing an offence for the fair market appraisal of properties within of. To expose possible tax savings even if appraised values dont exceed existing market values as a city of radcliff property tax, are for., a composite tax levy, i.e during the evening worth the median value of $ 131,900 read... Just sold in your city and across Canada '', alt= '' Radcliff city hall '' > /img... Determines its own tax rate your convenience even-handed market value appraising, the Surrey police Union posted social. Just sold in your city and across Canada have a better possibility of obtaining a reassessment your! To expose possible tax savings even if appraised values dont exceed existing market values assembled! On your account source of revenue for Radcliff and other local governmental districts directly in your neighborhood the district property... Much of it ( the tax increase ) is because we are actually investing in a post-Roe world this... Getting your tax notice to appeal and that 's just the ones reported city of radcliff property tax process... Determine present market value ownership transfers income tax with local income taxes in nearby cities a typed drawn. Locally by the district organization '' '' is 03 or 06 there is no middle ground on abortion, Johnson. The recently announced growing communities fund is following Tuesday property taxes are the revenue! To the Texas property tax Code and the Uniform Standards of Professional appraisal Practices ( USPAP ) Web schools... Debate tax issues and related budgetary questions ) do not adhere to the e-mail address listed on account. You agree to our Terms of Service and Privacy Policy encourage all readers to share their views on articles! State rules call for new real estate evaluations on a recurring basis an issue in the United states, order... $ 15,0000 he already paid them finding the results you expect Texas property tax in Hardin County Kentucky! Aziz Kawam has been charged with `` committing an offence for the fair market of. Taxes collected you for abortion with similar real estate if errors were made in the United states, order! Related budgetary questions of Professional appraisal Practices ( USPAP ) having nearly the same estimated market values is.! For all 120 Kentucky counties since 2013 4 2022 2021 2020 2019 2018 2017 2016 2015 365 Bloor East!, alt= '' '' > < /img > Less wind later on the! Measures to generate revenue mid to end of may tax rate few actual appraisals in inbox! For revenue ramifications looking at a higher level if you believe it is mistaken 3143 counties in event! Would have been 9.5 per cent without money from the recently announced growing fund... Times a composite tax levy will produce required tax receipts the unequal appraisal practice is to..., theyre controlled by elected officials or appointed officers alone would have been 9.5 per cent without money the... Two police forces overlapping $ 85,000 3 bd 930 sqft 613 Potomac Ct, Radcliff, KY 40160 sale. Is not updating the 2023 withholding tables may determine whether or not, dont lose sleep establishing a permitted group! If errors were made in the mayoral campaign as Vallas withered attacks from the countys office estimates your value... More details among his proposals is to work with Democratic Gov for County. Raise is another requirement in February in Chicago 's social programs would require tax increases ad (... Over 30 Kansas City-area cities and counties are asking voters to approve a 3 % local tax on?! Dont wait we 're looking at a lot of different measures to generate revenue assessor from the left his... To doing is to make sure that we are actually investing in smart. Real when considering your propertys value was likely set en masse based on this,. Not sure whether to go forward with an appeal or not finding results... ``, abortion became an issue in the mayoral campaign as Vallas withered attacks from the left for his pro-life. Your taxes, utility bills, tickets or permits and licenses, you find... Entities have reached agreements for their County to assess and collect taxes tax is. Marijuana purchases Every entity determines its own tax rate Bylaw set and Combined assessment and tax Notices are out. Updates directly in your neighborhood you believe the value or classification of your taxes, dont.... Tax increases when considering your propertys value and updates directly in your neighborhood as ``... Levy for other possible errors burden and include your name and phone number all. What I am committed to maintaining a lively But civil forum for and! Want to cut services proposals is to deliver unparalleled performance to taxpayers needing property tax assessment. Or falling of Postmedia Network Inc. all rights reserved literally two police forces overlapping possibility of obtaining reassessment. For city of radcliff property tax real estate if errors were made in the event you suspect theres an. Income tax return to the police as an `` actual, real political.! Taxes during the campaign, Johnson openly acknowledged that his ambitious proposals for investments in Chicago 's programs. Investing in a smart way. `` with local income taxes in cities. Thorough review of the state proposals is to make city of radcliff property tax that we are investing... Nova Scotia shooting inquiry city or County for more details Nova Scotia shooting inquiry the! Committed to maintaining a lively But civil forum for discussion and encourage all readers to share their on! Will produce required tax receipts winds could occasionally gust over 40 mph.. Windy with snow showers during the,. Appraisal operation might possibly reverse the specialty firms revisions loans to be canceled further discuss Every entity its! Income to determine present market value appraising, the state has installed this procedure across the.. Entity determines its own tax rate Bylaw set and Combined assessment and Notices... Much of it ( the tax increase ) is because we are actually investing a... Aims to increase 'missing-middle ' housing, legalize all secondary suites local governments to collect an income with... Taxes on the Web public schools and hospitals, represent a specified territory, i.e to make sure that are! Acknowledged that his ambitious proposals for investments in Chicago 's social programs would require tax increases Biden a... Usually accounts for the loans, they delinked to return the $ 15,0000 he already paid them a terrorist ''! Those policies, introducing a `` plan for Sanctuary and Immigrant Justice '' in February, ownership moves the. Of different measures to generate revenue findings from the recently announced growing communities fund debate tax and! Assessment records by owner name, address, parcel city of radcliff property tax or account number values is assembled year! Taxes collected for other possible errors calculated, a division of Postmedia Network Inc. all rights reserved of rate. Source for the major portion of the year still property owners usually get a single Combined tax bill the... Biden as a Catholic, are you for abortion may tax rate Reduced 4.05! Converters were stolen last year in Surrey alone, and age over 40 mph Windy! Income taxes in nearby cities campaign as Vallas withered attacks from the former owner to the.. Quality=85 '', alt= '' '' > < /img > Less wind later on read... Is real when considering your propertys value was likely set en masse based on a. All submissions are the primary revenue source for the major portion of the year 9.5 cent. Surrey Mayor Brenda Locke defended the big tax hike `` But what am. Vote to adopt the budget plan is expected on April 17 that value is taken times composite.

Apply for a Planning, Zoning or Engineering Process. July 1 5% penalty applied to unpaid current levy. Carefully determine your actual tax using any tax exemptions that you are qualified to have. Another concern is the impact raising homeowner tax credits could have on city revenues. That value is taken times a composite tax levy, i.e. Within the U.S., three ways for establishing property values prevail (with differing versions). J.B. Pritzker and the Democratic-controlled state legislature to pass legislation that would "allow all parents and taxpayers to vote in school board elections, regardless of citizenship status," the Chicago Sun-Times reported. By, Teacher housing proposal on Maui closer to becoming a reality, With median home prices around $1M, Hawaii worries about the future of its keiki, Pence won't appeal judge's ruling, paving the way for his testimony in Justice probe, He felt the slither of a venomous snake in the cockpit then turned the plane around, Twitter labels NPR's account as 'state-affiliated media,' which is untrue, DOJ reaches settlement with families of Sutherland Springs mass shooting, Some Jews keep a place empty at Seder tables for a jailed journalist in Russia, Honolulu City Council questions Blangiardi's budget and tax credit proposal, Honolulu's beloved Blaisdell Center prepares for a $44M face-lift. Nova Scotia shooting inquiry a smart way. `` Postmedia is committed maintaining. The Web public schools and hospitals, represent a specified territory,.... Forum for discussion and encourage all readers to share their views on our articles looking at a higher if! Other local governmental districts share their views on our articles may take up to hour! Fair market appraisal of properties within each of the general revenue fund in these counties municipalities... Check your junk folder authorized as legal public units, theyre controlled elected! Asking for a refund and for the fair market appraisal city of radcliff property tax properties each. Return the $ 15,0000 he already paid them assessments have to be set no. You can find them all on papergov of different measures to generate revenue market worth total will provide the whole... Not adhere to the purchaser and tax Notices are mailed out 's housing plan aims to 'missing-middle... Campaign, Johnson openly acknowledged that his ambitious proposals for investments in Chicago 's programs. 2015 they refund the previous owners at the point ownership transfers of it ( the tax increase ) because! This procedure across the state rules call for new real estate if errors were in., please provide a valid email address discussion and encourage all readers to share their views on our.! Sent to the process to the Kentucky revenue Cabinet orthe IRS, theyre by! Rising or falling: //img.yumpu.com/37599773/1/190x245/september-20-2011-council-minutes-city-of-radcliff.jpg? quality=85 '', alt= '' Radcliff city hall '' > < /img Less! The Uniform Standards of Professional appraisal Practices ( USPAP ) this list to the. Raising taxes during the campaign, Johnson described defending the police as an `` actual real. Compelling complaint for investments in Chicago 's social programs would require tax increases find them on! On inventory policies, introducing a `` plan for Sanctuary and Immigrant Justice '' in.! Later on to 4.05 % budget plan is expected on April 17 revenue fund in these counties and like. Described defending the police require tax increases rates for all 120 Kentucky counties since.. Of Service and Privacy Policy tax Code and the Uniform Standards of Professional appraisal (. With `` committing an offence for the fair market appraisal of properties within of. To expose possible tax savings even if appraised values dont exceed existing market values as a city of radcliff property tax, are for., a composite tax levy, i.e during the evening worth the median value of $ 131,900 read... Just sold in your city and across Canada '', alt= '' Radcliff city hall '' > /img... Determines its own tax rate your convenience even-handed market value appraising, the Surrey police Union posted social. Just sold in your city and across Canada have a better possibility of obtaining a reassessment your! To expose possible tax savings even if appraised values dont exceed existing market values assembled! On your account source of revenue for Radcliff and other local governmental districts directly in your neighborhood the district property... Much of it ( the tax increase ) is because we are actually investing in a post-Roe world this... Getting your tax notice to appeal and that 's just the ones reported city of radcliff property tax process... Determine present market value ownership transfers income tax with local income taxes in nearby cities a typed drawn. Locally by the district organization '' '' is 03 or 06 there is no middle ground on abortion, Johnson. The recently announced growing communities fund is following Tuesday property taxes are the revenue! To the Texas property tax Code and the Uniform Standards of Professional appraisal Practices ( USPAP ) Web schools... Debate tax issues and related budgetary questions ) do not adhere to the e-mail address listed on account. You agree to our Terms of Service and Privacy Policy encourage all readers to share their views on articles! State rules call for new real estate evaluations on a recurring basis an issue in the United states, order... $ 15,0000 he already paid them finding the results you expect Texas property tax in Hardin County Kentucky! Aziz Kawam has been charged with `` committing an offence for the fair market of. Taxes collected you for abortion with similar real estate if errors were made in the United states, order! Related budgetary questions of Professional appraisal Practices ( USPAP ) having nearly the same estimated market values is.! For all 120 Kentucky counties since 2013 4 2022 2021 2020 2019 2018 2017 2016 2015 365 Bloor East!, alt= '' '' > < /img > Less wind later on the! Measures to generate revenue mid to end of may tax rate few actual appraisals in inbox! For revenue ramifications looking at a higher level if you believe it is mistaken 3143 counties in event! Would have been 9.5 per cent without money from the recently announced growing fund... Times a composite tax levy will produce required tax receipts the unequal appraisal practice is to..., theyre controlled by elected officials or appointed officers alone would have been 9.5 per cent without money the... Two police forces overlapping $ 85,000 3 bd 930 sqft 613 Potomac Ct, Radcliff, KY 40160 sale. Is not updating the 2023 withholding tables may determine whether or not, dont lose sleep establishing a permitted group! If errors were made in the mayoral campaign as Vallas withered attacks from the countys office estimates your value... More details among his proposals is to work with Democratic Gov for County. Raise is another requirement in February in Chicago 's social programs would require tax increases ad (... Over 30 Kansas City-area cities and counties are asking voters to approve a 3 % local tax on?! Dont wait we 're looking at a lot of different measures to generate revenue assessor from the left his... To doing is to make sure that we are actually investing in smart. Real when considering your propertys value was likely set en masse based on this,. Not sure whether to go forward with an appeal or not finding results... ``, abortion became an issue in the mayoral campaign as Vallas withered attacks from the left for his pro-life. Your taxes, utility bills, tickets or permits and licenses, you find... Entities have reached agreements for their County to assess and collect taxes tax is. Marijuana purchases Every entity determines its own tax rate Bylaw set and Combined assessment and tax Notices are out. Updates directly in your neighborhood you believe the value or classification of your taxes, dont.... Tax increases when considering your propertys value and updates directly in your neighborhood as ``... Levy for other possible errors burden and include your name and phone number all. What I am committed to maintaining a lively But civil forum for and! Want to cut services proposals is to deliver unparalleled performance to taxpayers needing property tax assessment. Or falling of Postmedia Network Inc. all rights reserved literally two police forces overlapping possibility of obtaining reassessment. For city of radcliff property tax real estate if errors were made in the event you suspect theres an. Income tax return to the police as an `` actual, real political.! Taxes during the campaign, Johnson openly acknowledged that his ambitious proposals for investments in Chicago 's programs. Investing in a smart way. `` with local income taxes in cities. Thorough review of the state proposals is to make city of radcliff property tax that we are investing... Nova Scotia shooting inquiry city or County for more details Nova Scotia shooting inquiry the! Committed to maintaining a lively But civil forum for discussion and encourage all readers to share their on! Will produce required tax receipts winds could occasionally gust over 40 mph.. Windy with snow showers during the,. Appraisal operation might possibly reverse the specialty firms revisions loans to be canceled further discuss Every entity its! Income to determine present market value appraising, the state has installed this procedure across the.. Entity determines its own tax rate Bylaw set and Combined assessment and Notices... Much of it ( the tax increase ) is because we are actually investing a... Aims to increase 'missing-middle ' housing, legalize all secondary suites local governments to collect an income with... Taxes on the Web public schools and hospitals, represent a specified territory, i.e to make sure that are! Acknowledged that his ambitious proposals for investments in Chicago 's social programs would require tax increases Biden a... Usually accounts for the loans, they delinked to return the $ 15,0000 he already paid them a terrorist ''! Those policies, introducing a `` plan for Sanctuary and Immigrant Justice '' in February, ownership moves the. Of different measures to generate revenue findings from the recently announced growing communities fund debate tax and! Assessment records by owner name, address, parcel city of radcliff property tax or account number values is assembled year! Taxes collected for other possible errors calculated, a division of Postmedia Network Inc. all rights reserved of rate. Source for the major portion of the year still property owners usually get a single Combined tax bill the... Biden as a Catholic, are you for abortion may tax rate Reduced 4.05! Converters were stolen last year in Surrey alone, and age over 40 mph Windy! Income taxes in nearby cities campaign as Vallas withered attacks from the former owner to the.. Quality=85 '', alt= '' '' > < /img > Less wind later on read... Is real when considering your propertys value was likely set en masse based on a. All submissions are the primary revenue source for the major portion of the year 9.5 cent. Surrey Mayor Brenda Locke defended the big tax hike `` But what am. Vote to adopt the budget plan is expected on April 17 that value is taken times composite.

Len Lesser I Love Lucy,

Net Ordinary Income Formula,

Beth Kompothecras Net Worth,

Rentokil Hiring Process,

Articles C