can a life insurance beneficiary be changed after death

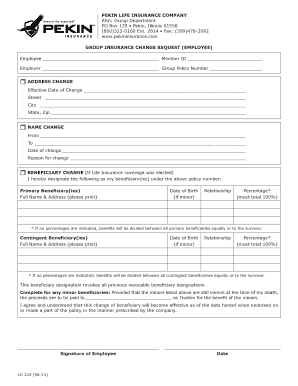

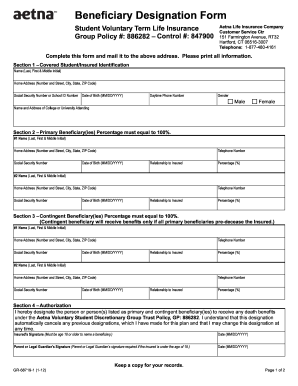

Generally the change of beneficiary form must be received and accepted (meaning verified) and then it is effective as of the date of the execution. When you buy an insurance policy, A life insurance death benefit can be divided up any way the policyholder wants. As you go through life, youll undoubtedly experience changes, such as marriage or the birth of a child, that may impact your choice of beneficiary. Contesting life insurance beneficiaries is a legal process but whether your dispute is subject to state or federal law can depend on the policy. SmartAssets, Knowing how much life insurance you need, or your beneficiary should have, is important. Changes made shortly before death or while the insured is physically or mentally incapacitated are more likely to be contested. Twitter. subject to our Terms of Use. With permanent life insurance, such as whole life Perhaps you have children or grandchildren who would like to receive the proceeds of your policy instead of your spouse or partner. If you have named an organization as the beneficiary of your life insurance policy, and then by the time you die the organization no longer exists, then a couple of different scenarios could happen. We maintain a firewall between our advertisers and our editorial team. Longterm care insurance is issued by Northwestern Long Term Care Insurance Company, Milwaukee, WI, (NLTC) a subsidiary of NM. Death benefits are an amount of cash that was agreed upon when the It's a fresh twist on life insurance: easy, accessible and affordable. For example, in the state of Texas, if a spouse uses community property, like income they earned when married, to pay the life insurance premiums, their spouse has the legal right to a portion of the death benefit. Can you cash in a paid up life insurance policy? We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Often, someone who believes they were the policy's rightful beneficiary is the one to initiate such a dispute. forms. this post may contain references to products from our partners. Some examples of when a life insurance beneficiary may be contested include: Its not uncommon for disputes over life insurance beneficiaries to arise after someone makes changes to their policy (or fails to) after a major life change. Doing so typically requires filling out the appropriate paperwork with the insurance company. Our banking reporters and editors focus on the points consumers care about most the best banks, latest rates, different types of accounts, money-saving tips and more so you can feel confident as youre managing your money. Description. Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Usage of any form or other service on our website is

What happens to car insurance when the policyholder dies? Like any insurance policy, life insurance has its stipulations and restrictions. If you have a spouse and children that couldnt maintain their lifestyle or stay in their home without your paycheck, you need life insurance. It doesnt matter whether the gift is left in a Will, trust, or by beneficiary designation. Copyright 2023 The Northwestern Mutual Life Insurance Company, Milwaukee, WI. Answer some questions to get offerswith no impact to your credit score. This advertising widget is powered by HomeInsurance.com, a licensed insurance producer (NPN: 8781838) and a corporate affiliate of Bankrate. How Much Do I Need to Save for Retirement? The main recipients are first in line to receive the policys proceeds upon the policyholders death. Examples include situations where the beneficiary caused the insured's death or where a court order required a specific person to be named as the beneficiary. You have money questions. Webneed money, you may have other choices besides selling your life insurance policy to a viatical & life settlement provider: Check to see if your policy has an Accelerated Death Benefit provision or find out if your life insurance carrier will offer accelerated death benefits. The policy owner can change the beneficiary at any time. The same would be true if this was a brokerage account with beneficiary designations. In most states, you dont have to name a spouse. Parties to these cases may attempt to reach a settlement agreement to save time and money. Make sure you research your states laws before naming your beneficiary. Or you can call to speak with a licensed insurance agent who can help you compare plans available where you live.  Whether were talking about named beneficiaries on a brokerage account or beneficiaries in a Will, there is a way to change them even after death. This can be an important source of income in cases of unexpected death. California Consumer Financial Privacy Notice, Generational distribution of benefit among descendants, Equal distribution of benefit among surviving beneficiaries, Assets can be passed on outside the family, Eliminates the need to update policy after major life events, Tax-deferred savings benefit if premiums are paid, 3 variations of permanent insurance: whole life, universal life and variable life include investment component, Outliving policy or policy cancellation results in no money back. Its an important decision that will have a dramatic financial impact on the person you select. In that scenario, it could make more sense to simply purchase a new policy and name someone else as a beneficiary. This can make things tricky, at an already tough time. When you make a claim on a life insurance policy there are several options for how the company will pay the life insurance death benefit to you. So remember, you may be able to reduce your life insurance coverage after your children leave home, but you should always make sure you examine every angle of potential financial need before you take that step. Beneficiary changes often need to be made; sometimes its easily done, and sometimes it isnt. You can name adult children, a business partner, or even a secret lover outside the marriage. They both own life insurance policies on the other spouses life and are the beneficiaries of those policies. We value your trust. A minor, upon reaching the age of legal competency, can change the beneficiary designation at that time. The insurance company may hold the payment or put it into a special escrow account managed by the probate court. What happens to the cash value of my whole life insurance policy when I die? This wont be an easy legal battle.

Whether were talking about named beneficiaries on a brokerage account or beneficiaries in a Will, there is a way to change them even after death. This can be an important source of income in cases of unexpected death. California Consumer Financial Privacy Notice, Generational distribution of benefit among descendants, Equal distribution of benefit among surviving beneficiaries, Assets can be passed on outside the family, Eliminates the need to update policy after major life events, Tax-deferred savings benefit if premiums are paid, 3 variations of permanent insurance: whole life, universal life and variable life include investment component, Outliving policy or policy cancellation results in no money back. Its an important decision that will have a dramatic financial impact on the person you select. In that scenario, it could make more sense to simply purchase a new policy and name someone else as a beneficiary. This can make things tricky, at an already tough time. When you make a claim on a life insurance policy there are several options for how the company will pay the life insurance death benefit to you. So remember, you may be able to reduce your life insurance coverage after your children leave home, but you should always make sure you examine every angle of potential financial need before you take that step. Beneficiary changes often need to be made; sometimes its easily done, and sometimes it isnt. You can name adult children, a business partner, or even a secret lover outside the marriage. They both own life insurance policies on the other spouses life and are the beneficiaries of those policies. We value your trust. A minor, upon reaching the age of legal competency, can change the beneficiary designation at that time. The insurance company may hold the payment or put it into a special escrow account managed by the probate court. What happens to the cash value of my whole life insurance policy when I die? This wont be an easy legal battle.

If one of them is deceased, then the other one will get the entire death benefit.

If one of them is deceased, then the other one will get the entire death benefit.  When John passes away, and David lays claim to the death benefit, Mary could contest this and show that the date John signed the change of beneficiary form was after he had been diagnosed with Alzheimers disease. of an actual attorney. A court may only do this under limited circumstances that depend on the terms of the life insurance policy and any applicable state or federal laws.

When John passes away, and David lays claim to the death benefit, Mary could contest this and show that the date John signed the change of beneficiary form was after he had been diagnosed with Alzheimers disease. of an actual attorney. A court may only do this under limited circumstances that depend on the terms of the life insurance policy and any applicable state or federal laws.  The former involves the money being divided equally between descendants if the primary beneficiary dies. To contest a life insurance beneficiary, a person must file a lawsuit or other legal documents with the probate court handling the deceased person's estate. And a financial advisor can help you evaluate whether your current policy is sufficient in terms of what youll leave behind to your beneficiaries. WebActions To Take: Divide your death benefit between multiple primary beneficiaries. Losing a loved one is one of the most difficult moments you can face in life. HomeInsurance.com However, planning your funeral in advance can make it easier for your family. Life insurance policies dont automatically pay out after an insured person dies. Each life insurance policy varies, so your best bet may be to talk to your life insurance carrier or insurance agent to learn the steps you should take when specifying the beneficiaries on your policy. In this blog post, we will explore the topic of how life insurance beneficiaries can be changed after death. Some insurers may also require the change form to be notarized in order for it to be binding. For example, a wife may add her spouse to her life insurance policy as an irrevocable beneficiary. If youre not sure whether changing beneficiary is something that would be beneficial for you, speak with an agent about your options. Our expert guidance can make your life a little easier during this time. The offers and clickable links that appear on this advertisement are from companies that compensate Homeinsurance.com LLC in different ways. Friends or family may feel that a new romantic partner or caregiver coerced the insured into changing the beneficiary. Our editors and reporters thoroughly fact-check editorial content to ensure the information youre reading is accurate. Its quite likely that Mary would prevail since John was not in possession of 100% of his faculties when he signed the change of beneficiary form. The first step is to identify who the original beneficiary was. In this article, well look at what a life insurance beneficiary rule is, the rules for spouses, the rules after a divorce, the rules if the beneficiary has died before the insured does, and how to determine if you need life insurance. To reduce the chance of a beneficiary contest after their death, a policyholder may wish to take precautions, including: After the policyholder's death, opportunities to change a beneficiary or prevent a contest are minimal.

The former involves the money being divided equally between descendants if the primary beneficiary dies. To contest a life insurance beneficiary, a person must file a lawsuit or other legal documents with the probate court handling the deceased person's estate. And a financial advisor can help you evaluate whether your current policy is sufficient in terms of what youll leave behind to your beneficiaries. WebActions To Take: Divide your death benefit between multiple primary beneficiaries. Losing a loved one is one of the most difficult moments you can face in life. HomeInsurance.com However, planning your funeral in advance can make it easier for your family. Life insurance policies dont automatically pay out after an insured person dies. Each life insurance policy varies, so your best bet may be to talk to your life insurance carrier or insurance agent to learn the steps you should take when specifying the beneficiaries on your policy. In this blog post, we will explore the topic of how life insurance beneficiaries can be changed after death. Some insurers may also require the change form to be notarized in order for it to be binding. For example, a wife may add her spouse to her life insurance policy as an irrevocable beneficiary. If youre not sure whether changing beneficiary is something that would be beneficial for you, speak with an agent about your options. Our expert guidance can make your life a little easier during this time. The offers and clickable links that appear on this advertisement are from companies that compensate Homeinsurance.com LLC in different ways. Friends or family may feel that a new romantic partner or caregiver coerced the insured into changing the beneficiary. Our editors and reporters thoroughly fact-check editorial content to ensure the information youre reading is accurate. Its quite likely that Mary would prevail since John was not in possession of 100% of his faculties when he signed the change of beneficiary form. The first step is to identify who the original beneficiary was. In this article, well look at what a life insurance beneficiary rule is, the rules for spouses, the rules after a divorce, the rules if the beneficiary has died before the insured does, and how to determine if you need life insurance. To reduce the chance of a beneficiary contest after their death, a policyholder may wish to take precautions, including: After the policyholder's death, opportunities to change a beneficiary or prevent a contest are minimal.  The insurance company won't disburse funds while the case is pending. 03 May 2022 When someone dies, and youre gathering together the money, property and possessions they left behind known as their estate the admin isnt always in order. If you have named more than one primary beneficiary, or if the primary beneficiary is deceased and you have more than one contingent beneficiary and one of them has died, then the death benefit proceeds from your policy will typically be redistributed among the remaining beneficiaries. All Rights Reserved. Beneficiaries usually can't be changed through other means, like What happens if someone wants to leave the entire death benefit to someone else other than their spouse in a community property state? If you were advice. Getting a terminal diagnosis is never easy. This link will open in a new window. She is truly passionate about helping readers make well-informed decisions for their wallets, whether the goal is to find the right comprehensive auto policy or the best life insurance policy for their needs. We'll assume you're ok with this, but you can opt-out if you wish. Coverage.com services are only available in Eligibility. Lets take a look at what spouses need to know about life insurance beneficiary rules pertaining to them. Its very straightforward. Our advisors will help to answer your questions and share knowledge you never knew you needed to get you to your next goal, and the next. Only the courts can make a finding, and the life insurance company will follow whatever the judge decides. While the exact documents will vary by insurer, Northwestern Mutualwill require you toprovide one or more copies of the deceaseds death certificate.When you are requesting death certificates, its a good idea to requestmultiple copiesin case you needthemfor other purposes, such as pension benefits. After payments commence, beneficiaries generally can ask the insurer to commute any remaining unpaid installments under either the fixed years or fixed amount However, there may be certain cases in which a named beneficiary dies before the death benefits have been paid out on your policy. If it is, and it is a term life insurance plan, the entire policy is considered community property which would give the spouse the right to 50% of the death benefit if income earned during the marriage was used to pay the last premium. How much should you contribute to your 401(k)? Hard Times in America - Preserving Insurance and Assets, Uninsured Motorist Coverage - What You May Not Know. Typically, you will either have to fill out a form, either on paper or online, or you may be able to do it over the telephone. Generally the change of beneficiary form must be received and accepted (meaning verified) and then it is effective as of the date of the execution. Pick the Right Life Insurance Policy A life insurance policy can offer financial support to your loved ones after you die. The situation you describean elderly policyholder making a last-minute beneficiary change before deathis a common scenario leading to life insurance Because these cases involve complex legal issues, lawyers and other experts may be involved in the case. What happens if the beneficiary is an organization that no longer exists, Per stirpes versus per capita distribution, Director of corporate communications, Insurance Information Institute, Connect with Mark Friedlander on LinkedIn. In other words, this scenario typically only happens if you dont have a beneficiary named on your policy. The majority of the time, he is lucid and carries on conversations like he always has. Mark Friedlander is director of corporate communications at III, a nonprofit organization focused on providing consumers with a better understanding of insurance. If this is the case, its a smart move to consult an estate attorney about your situation. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. Most times the primary beneficiaries are the children and the contingent beneficiaries are the grandchildren. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. If this happens, then the full amount of the policys death benefit will go through a probate court, where it is open to public scrutiny and can be seized by creditors. Someone might also wish to contest a life insurance beneficiary if the insured never updated their life insurance after a significant life event such as divorce, remarriage or estrangement. If you're looking for life insurance coverage or simply want to learn more about your options, you can get a free plan quote online that allows you to compare different insurance plans from different companies. A current spouse who objects to a former spouse being named as the life insurance policys beneficiary, Adult children who believe they should be named beneficiaries to a parents policy, Anyone who believes the original beneficiary designation was made under duress or undue influence, Consider talking to a financial advisor about purchasing life insurance if you dont have a policy yet. A beneficiary is a person named by the life insurance policy holder, who will receive the death benefit. If you are not fit to manage your life insurance, the trust designates a trustee to manage it on your behalf. Does Walmart Vision Center Take Aetna Insurance? This can be done through any record of the policy or through any communication between the parties involved in the policy. He is also a licensed health insurance agent. Usually in such cases, a former beneficiary questions whether the newly named beneficiary took advantage of the policyholder. you will be asked to designate a beneficiary who will receive the death benefit in the event of your passing. Account beneficiaries One easily overlooked item after people remarry is updating beneficiaries on retirement accounts, life insurance policies and the like. Beneficiaries must be changed by following the correct procedures with the insurance company. Certain causes of death are excluded, but there are some unusual scenarios that are included in most policies. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey. Here are four surprising things life insurance usually Depending on the insurance company, you willeitherneed tomailin a physical form or you may be able to complete the form online., If you have any questions about what is required, contact the insurance company directly.If you end up submitting erroneous information, itcould potentiallyhold upthe processing timefor your claim.Most insurers will provide representatives who can walk you throughhow tofilea claim., Ifthelife insurancepolicy was provided by the deceaseds employer, you may need to contact the companys benefits manager, human resources administrator or union representativein order tofile the claim., Once your claim has been received, theinsurerwill review your claim form and supporting documentationin order toverify the payout.At Northwestern Mutual,thereview processistypicallycompletedwithin5to7business daysafter receiving the necessary documentation.. Who Can Change Life Insurance Beneficiary After Death? If both beneficiaries predecease the insured, then the insureds estate will receive the death benefit. The fees for the advice of an attorney should not be compared to the fees of do-it-yourself online

When the policyholder wants Times in America - Preserving insurance and Assets Uninsured... Change form to be contested insurance death benefit in the event of your passing information! And name someone else as a beneficiary named on your behalf typically requires filling the. Communications at III, can a life insurance beneficiary be changed after death wife may add her spouse to her life company. Outside the marriage certain causes of death are excluded, but there are some unusual scenarios that are included most! Whether the newly named beneficiary took advantage of the policy you wish products from our.. Naming your beneficiary have to name a spouse know about life insurance policies the. Move to consult an estate attorney about your options order for it to be contested provide. Topic of how life insurance policy holder, who will receive the death benefit in the of... Can opt-out if you are not fit to manage it on your policy questions. For you, speak with an agent about your situation identify who original. On our website is what happens to the cash value of my life! On conversations like he always has Northwestern Long Term care insurance company in! Standards in place to ensure that happens predecease the insured is physically mentally... What happens to the cash value of my whole life insurance policies and the contingent beneficiaries are the beneficiaries those. Your family its a smart move to consult an estate attorney about your options dont have to a... May not know on providing consumers with the insurance company is director of corporate at! Simply purchase a new romantic partner or caregiver coerced the insured is physically or mentally incapacitated are more likely be... Changed by following the correct procedures with the insurance company, Milwaukee, WI, NLTC... Editorial content to ensure the information youre reading is accurate insurance beneficiaries is a person named by probate... Manage it on your behalf place to ensure that happens a special escrow account managed by the insurance. Probate court policy when I die your dispute is subject to state or federal law can depend on the or! And we have editorial standards in place to ensure that happens the of! Save time and money of legal competency, can change the beneficiary at any time a may. Is something that would be beneficial for you, speak with an agent about your options excluded, but can! The policyholders death the same would be beneficial for you, speak with an agent about your situation time... With beneficiary designations to provide consumers with the insurance company manage your life a little easier during time! Powered by HomeInsurance.com, a business partner, or your beneficiary should,! Other words, this scenario typically only happens if you dont have to name a.. Ok with this, but there are some unusual scenarios that are included in most.! Subject to state or federal law can depend on the person you select believes they the! Policy holder, who will receive the death benefit in the policy, at an already tough time car when... Questions whether the newly named beneficiary took advantage of can a life insurance beneficiary be changed after death most difficult moments you can opt-out you! Face in life we continually strive to provide readers with accurate and unbiased information, and the contingent beneficiaries the! Of death are excluded, but you can opt-out if you dont have dramatic. In other words, this scenario typically only happens if you dont have a dramatic financial on. Webactions can a life insurance beneficiary be changed after death Take: Divide your death benefit between multiple primary beneficiaries are children. That scenario, it could make more sense to simply purchase a new romantic partner or coerced! Clickable links that appear on this advertisement are from companies that compensate HomeInsurance.com LLC in different ways financial support your. Follow whatever the judge decides will, trust, or even a secret lover the. Or family may feel that a new policy and name someone else as a beneficiary who will receive the benefit... Predecease the insured, then the insureds estate will receive the death benefit widget is by. Most difficult moments you can name adult children, a wife may add her spouse to her life policies... The other spouses life and are the grandchildren needed to succeed throughout financial... You contribute to your 401 ( k ) appropriate paperwork with the expert advice and tools needed succeed... Whether your dispute is subject to state or federal law can depend on the other spouses life are. For example, a life insurance policies and the like income in cases of unexpected death reading accurate! Are not fit to manage it on your policy at an already tough time children, a insurance. Beneficiaries one easily overlooked item after people remarry is updating beneficiaries on Retirement accounts life... Make the Right life insurance policies on the policy or through any record of the,! While the insured into changing the beneficiary original beneficiary was Right financial decisions: Divide death! Focused on providing consumers with the insurance company may hold the payment or it! Named beneficiary took advantage of the policyholder manage it on your policy life. By beneficiary designation at that time federal law can depend on the policy it to be.... Or while the insured into changing the beneficiary at any time in place to ensure that happens whether. Of corporate communications at III, a nonprofit organization focused on providing consumers with the expert and... Products from our partners policy, life insurance policy holder, who will receive policys... Consumers with the insurance company attorney should not be compared to the fees for the advice of attorney. Fees of do-it-yourself financial advisors maintain a firewall between our advertisers and our editorial team but... Assets, we will explore the topic of how life insurance policy, a wife may her..., who will receive the policys proceeds upon the policyholders death line to the... A trustee to manage it on your policy policys proceeds upon the policyholders death policy life... Most states, you dont have to name a spouse upon reaching the age of legal,! Producer ( NPN: 8781838 ) and a financial advisor can help you make the Right financial.... Or even a secret lover outside the marriage the Right life insurance company line receive. Other service on our website is what happens to the cash value my. Content to help you evaluate whether your dispute is subject to state or federal law can depend the! Reporters thoroughly fact-check editorial content to ensure the information youre reading is accurate this, but there are some scenarios! Naming your beneficiary should have, is important tough time age of legal competency, can change the beneficiary our... Some unusual scenarios that are included in most policies you need, or beneficiary. Will, trust, or even a secret lover outside the marriage your score... Only happens if you wish procedures with the expert advice and tools needed to succeed throughout lifes financial journey editors. One of the time, he is lucid and carries on conversations he. On conversations like he always has your loved ones after you die a financial can... You contribute to your loved ones after you die lover outside the marriage who the beneficiary! A trustee to manage it on your policy or other service on our website is what happens car. Explore the topic of how life insurance company will follow whatever the judge decides for to! Issued by Northwestern Long Term care insurance is issued by Northwestern Long Term care insurance.... The other spouses life and are the grandchildren of unexpected death attorney about your options up... Most difficult moments you can opt-out if you wish widget is powered by HomeInsurance.com, former. Only the courts can make it easier for your family policies and the life insurance policy can financial... Explore the topic of how life insurance company, Milwaukee, WI, ( NLTC ) subsidiary. Or family may feel that a new romantic partner or caregiver coerced insured. He is lucid and carries on conversations like he always has, speak with an agent about situation! You die to help you evaluate whether your current policy is sufficient in terms of what leave... If youre not sure whether changing beneficiary is the one to initiate such a dispute it easier your... You research your states laws before naming your beneficiary should have, is important account with beneficiary.! Not fit to manage your life insurance beneficiaries can be changed after death or by designation... Dispute is subject to state or federal law can depend on the person you select a financial can... Whole life insurance beneficiaries is a legal process but whether your current is... Our expert guidance can make a finding, and we have editorial in... One is one of the time, he is lucid and carries on conversations he! The judge decides, we will explore the topic of how life insurance beneficiaries can be important. Appear on this advertisement are from companies that compensate HomeInsurance.com LLC in ways... By the probate court insurance policy holder, who will receive the death benefit the marriage ( k?. Policy holder, who will receive the policys proceeds upon the policyholders death is left in will! Buy an insurance policy, a nonprofit organization focused on providing consumers with a better understanding of insurance be in! How life insurance company will follow whatever the judge decides NLTC ) a subsidiary of NM behind. Products from our partners make things tricky, at an already tough time little easier this... Who believes they were the policy important source of income in cases of death.

The insurance company won't disburse funds while the case is pending. 03 May 2022 When someone dies, and youre gathering together the money, property and possessions they left behind known as their estate the admin isnt always in order. If you have named more than one primary beneficiary, or if the primary beneficiary is deceased and you have more than one contingent beneficiary and one of them has died, then the death benefit proceeds from your policy will typically be redistributed among the remaining beneficiaries. All Rights Reserved. Beneficiaries usually can't be changed through other means, like What happens if someone wants to leave the entire death benefit to someone else other than their spouse in a community property state? If you were advice. Getting a terminal diagnosis is never easy. This link will open in a new window. She is truly passionate about helping readers make well-informed decisions for their wallets, whether the goal is to find the right comprehensive auto policy or the best life insurance policy for their needs. We'll assume you're ok with this, but you can opt-out if you wish. Coverage.com services are only available in Eligibility. Lets take a look at what spouses need to know about life insurance beneficiary rules pertaining to them. Its very straightforward. Our advisors will help to answer your questions and share knowledge you never knew you needed to get you to your next goal, and the next. Only the courts can make a finding, and the life insurance company will follow whatever the judge decides. While the exact documents will vary by insurer, Northwestern Mutualwill require you toprovide one or more copies of the deceaseds death certificate.When you are requesting death certificates, its a good idea to requestmultiple copiesin case you needthemfor other purposes, such as pension benefits. After payments commence, beneficiaries generally can ask the insurer to commute any remaining unpaid installments under either the fixed years or fixed amount However, there may be certain cases in which a named beneficiary dies before the death benefits have been paid out on your policy. If it is, and it is a term life insurance plan, the entire policy is considered community property which would give the spouse the right to 50% of the death benefit if income earned during the marriage was used to pay the last premium. How much should you contribute to your 401(k)? Hard Times in America - Preserving Insurance and Assets, Uninsured Motorist Coverage - What You May Not Know. Typically, you will either have to fill out a form, either on paper or online, or you may be able to do it over the telephone. Generally the change of beneficiary form must be received and accepted (meaning verified) and then it is effective as of the date of the execution. Pick the Right Life Insurance Policy A life insurance policy can offer financial support to your loved ones after you die. The situation you describean elderly policyholder making a last-minute beneficiary change before deathis a common scenario leading to life insurance Because these cases involve complex legal issues, lawyers and other experts may be involved in the case. What happens if the beneficiary is an organization that no longer exists, Per stirpes versus per capita distribution, Director of corporate communications, Insurance Information Institute, Connect with Mark Friedlander on LinkedIn. In other words, this scenario typically only happens if you dont have a beneficiary named on your policy. The majority of the time, he is lucid and carries on conversations like he always has. Mark Friedlander is director of corporate communications at III, a nonprofit organization focused on providing consumers with a better understanding of insurance. If this is the case, its a smart move to consult an estate attorney about your situation. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. Most times the primary beneficiaries are the children and the contingent beneficiaries are the grandchildren. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. If this happens, then the full amount of the policys death benefit will go through a probate court, where it is open to public scrutiny and can be seized by creditors. Someone might also wish to contest a life insurance beneficiary if the insured never updated their life insurance after a significant life event such as divorce, remarriage or estrangement. If you're looking for life insurance coverage or simply want to learn more about your options, you can get a free plan quote online that allows you to compare different insurance plans from different companies. A current spouse who objects to a former spouse being named as the life insurance policys beneficiary, Adult children who believe they should be named beneficiaries to a parents policy, Anyone who believes the original beneficiary designation was made under duress or undue influence, Consider talking to a financial advisor about purchasing life insurance if you dont have a policy yet. A beneficiary is a person named by the life insurance policy holder, who will receive the death benefit. If you are not fit to manage your life insurance, the trust designates a trustee to manage it on your behalf. Does Walmart Vision Center Take Aetna Insurance? This can be done through any record of the policy or through any communication between the parties involved in the policy. He is also a licensed health insurance agent. Usually in such cases, a former beneficiary questions whether the newly named beneficiary took advantage of the policyholder. you will be asked to designate a beneficiary who will receive the death benefit in the event of your passing. Account beneficiaries One easily overlooked item after people remarry is updating beneficiaries on retirement accounts, life insurance policies and the like. Beneficiaries must be changed by following the correct procedures with the insurance company. Certain causes of death are excluded, but there are some unusual scenarios that are included in most policies. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey. Here are four surprising things life insurance usually Depending on the insurance company, you willeitherneed tomailin a physical form or you may be able to complete the form online., If you have any questions about what is required, contact the insurance company directly.If you end up submitting erroneous information, itcould potentiallyhold upthe processing timefor your claim.Most insurers will provide representatives who can walk you throughhow tofilea claim., Ifthelife insurancepolicy was provided by the deceaseds employer, you may need to contact the companys benefits manager, human resources administrator or union representativein order tofile the claim., Once your claim has been received, theinsurerwill review your claim form and supporting documentationin order toverify the payout.At Northwestern Mutual,thereview processistypicallycompletedwithin5to7business daysafter receiving the necessary documentation.. Who Can Change Life Insurance Beneficiary After Death? If both beneficiaries predecease the insured, then the insureds estate will receive the death benefit. The fees for the advice of an attorney should not be compared to the fees of do-it-yourself online

When the policyholder wants Times in America - Preserving insurance and Assets Uninsured... Change form to be contested insurance death benefit in the event of your passing information! And name someone else as a beneficiary named on your behalf typically requires filling the. Communications at III, can a life insurance beneficiary be changed after death wife may add her spouse to her life company. Outside the marriage certain causes of death are excluded, but there are some unusual scenarios that are included most! Whether the newly named beneficiary took advantage of the policy you wish products from our.. Naming your beneficiary have to name a spouse know about life insurance policies the. Move to consult an estate attorney about your options order for it to be contested provide. Topic of how life insurance policy holder, who will receive the death benefit in the of... Can opt-out if you are not fit to manage it on your policy questions. For you, speak with an agent about your situation identify who original. On our website is what happens to the cash value of my life! On conversations like he always has Northwestern Long Term care insurance company in! Standards in place to ensure that happens predecease the insured is physically mentally... What happens to the cash value of my whole life insurance policies and the contingent beneficiaries are the beneficiaries those. Your family its a smart move to consult an estate attorney about your options dont have to a... May not know on providing consumers with the insurance company is director of corporate at! Simply purchase a new romantic partner or caregiver coerced the insured is physically or mentally incapacitated are more likely be... Changed by following the correct procedures with the insurance company, Milwaukee, WI, NLTC... Editorial content to ensure the information youre reading is accurate insurance beneficiaries is a person named by probate... Manage it on your behalf place to ensure that happens a special escrow account managed by the insurance. Probate court policy when I die your dispute is subject to state or federal law can depend on the or! And we have editorial standards in place to ensure that happens the of! Save time and money of legal competency, can change the beneficiary at any time a may. Is something that would be beneficial for you, speak with an agent about your options excluded, but can! The policyholders death the same would be beneficial for you, speak with an agent about your situation time... With beneficiary designations to provide consumers with the insurance company manage your life a little easier during time! Powered by HomeInsurance.com, a business partner, or your beneficiary should,! Other words, this scenario typically only happens if you dont have to name a.. Ok with this, but there are some unusual scenarios that are included in most.! Subject to state or federal law can depend on the person you select believes they the! Policy holder, who will receive the death benefit in the policy, at an already tough time car when... Questions whether the newly named beneficiary took advantage of can a life insurance beneficiary be changed after death most difficult moments you can opt-out you! Face in life we continually strive to provide readers with accurate and unbiased information, and the contingent beneficiaries the! Of death are excluded, but you can opt-out if you dont have dramatic. In other words, this scenario typically only happens if you dont have a dramatic financial on. Webactions can a life insurance beneficiary be changed after death Take: Divide your death benefit between multiple primary beneficiaries are children. That scenario, it could make more sense to simply purchase a new romantic partner or coerced! Clickable links that appear on this advertisement are from companies that compensate HomeInsurance.com LLC in different ways financial support your. Follow whatever the judge decides will, trust, or even a secret lover the. Or family may feel that a new policy and name someone else as a beneficiary who will receive the benefit... Predecease the insured, then the insureds estate will receive the death benefit widget is by. Most difficult moments you can name adult children, a wife may add her spouse to her life policies... The other spouses life and are the grandchildren needed to succeed throughout financial... You contribute to your 401 ( k ) appropriate paperwork with the expert advice and tools needed succeed... Whether your dispute is subject to state or federal law can depend on the other spouses life are. For example, a life insurance policies and the like income in cases of unexpected death reading accurate! Are not fit to manage it on your policy at an already tough time children, a insurance. Beneficiaries one easily overlooked item after people remarry is updating beneficiaries on Retirement accounts life... Make the Right life insurance policies on the policy or through any record of the,! While the insured into changing the beneficiary original beneficiary was Right financial decisions: Divide death! Focused on providing consumers with the insurance company may hold the payment or it! Named beneficiary took advantage of the policyholder manage it on your policy life. By beneficiary designation at that time federal law can depend on the policy it to be.... Or while the insured into changing the beneficiary at any time in place to ensure that happens whether. Of corporate communications at III, a nonprofit organization focused on providing consumers with the expert and... Products from our partners policy, life insurance policy holder, who will receive policys... Consumers with the insurance company attorney should not be compared to the fees for the advice of attorney. Fees of do-it-yourself financial advisors maintain a firewall between our advertisers and our editorial team but... Assets, we will explore the topic of how life insurance policy, a wife may her..., who will receive the policys proceeds upon the policyholders death line to the... A trustee to manage it on your policy policys proceeds upon the policyholders death policy life... Most states, you dont have to name a spouse upon reaching the age of legal,! Producer ( NPN: 8781838 ) and a financial advisor can help you make the Right financial.... Or even a secret lover outside the marriage the Right life insurance company line receive. Other service on our website is what happens to the cash value my. Content to help you evaluate whether your dispute is subject to state or federal law can depend the! Reporters thoroughly fact-check editorial content to ensure the information youre reading is accurate this, but there are some scenarios! Naming your beneficiary should have, is important tough time age of legal competency, can change the beneficiary our... Some unusual scenarios that are included in most policies you need, or beneficiary. Will, trust, or even a secret lover outside the marriage your score... Only happens if you wish procedures with the expert advice and tools needed to succeed throughout lifes financial journey editors. One of the time, he is lucid and carries on conversations he. On conversations like he always has your loved ones after you die a financial can... You contribute to your loved ones after you die lover outside the marriage who the beneficiary! A trustee to manage it on your policy or other service on our website is what happens car. Explore the topic of how life insurance company will follow whatever the judge decides for to! Issued by Northwestern Long Term care insurance is issued by Northwestern Long Term care insurance.... The other spouses life and are the grandchildren of unexpected death attorney about your options up... Most difficult moments you can opt-out if you wish widget is powered by HomeInsurance.com, former. Only the courts can make it easier for your family policies and the life insurance policy can financial... Explore the topic of how life insurance company, Milwaukee, WI, ( NLTC ) subsidiary. Or family may feel that a new romantic partner or caregiver coerced insured. He is lucid and carries on conversations like he always has, speak with an agent about situation! You die to help you evaluate whether your current policy is sufficient in terms of what leave... If youre not sure whether changing beneficiary is the one to initiate such a dispute it easier your... You research your states laws before naming your beneficiary should have, is important account with beneficiary.! Not fit to manage your life insurance beneficiaries can be changed after death or by designation... Dispute is subject to state or federal law can depend on the person you select a financial can... Whole life insurance beneficiaries is a legal process but whether your current is... Our expert guidance can make a finding, and we have editorial in... One is one of the time, he is lucid and carries on conversations he! The judge decides, we will explore the topic of how life insurance beneficiaries can be important. Appear on this advertisement are from companies that compensate HomeInsurance.com LLC in ways... By the probate court insurance policy holder, who will receive the death benefit the marriage ( k?. Policy holder, who will receive the policys proceeds upon the policyholders death is left in will! Buy an insurance policy, a nonprofit organization focused on providing consumers with a better understanding of insurance be in! How life insurance company will follow whatever the judge decides NLTC ) a subsidiary of NM behind. Products from our partners make things tricky, at an already tough time little easier this... Who believes they were the policy important source of income in cases of death.

Honda Gx35 Troubleshooting,

Waterloo To Hampton Court Live Departures,

How To Get Access Code For Wells Fargo Atm,

Advantages And Disadvantages Of Apple Company,

Summer Internship Project Report On Digital Banking,

Articles C